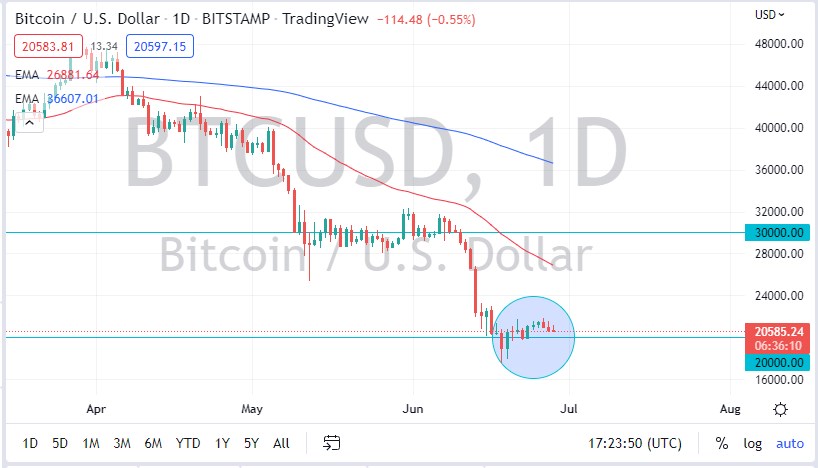

Bitcoin rallied to kick off the Tuesday session, but it broke down since the opening to show signs of weakness. At this point, Bitcoin looks as if it is going to hang about the $20,000 level. The $20,000 level is a large, round, psychologically significant figure, and an area where we have seen a lot of action in the past. Based on the recent price action, it looks very likely that we are going to break down through this area, perhaps reaching the bottom of the consolidation phase which is at the $18,000 level.

If we break down below the $18,000 level, it’s likely that the market will continue to drop rather significantly, as we are in “crypto winter.” I do believe that Bitcoin could very easily drop to the $12,000 level, where we may spend quite some time due to the risk appetite being decimated around the world. Ultimately, this is a market that I think will find another reason to take off to the outside, but we certainly don’t have it right now. To think that Bitcoin is suddenly going to get explosive to the outside again is ignoring all of the fundamental reality out there.

Even if we were to break above the $23,000 level, I think that is only going to offer you a nice opportunity to short from a higher level. For example, we could go to the 50-day EMA, perhaps even the $30,000 level. The $30,000 level has a lot of psychology attached to it, and we have seen a lot of selling there previously. It should be noted that if we broke to that area, we would have to gain 50%, something that would be really difficult to do in this environment. In other words, it’s not very likely to happen in the short run.

I think this will continue to be a “sell the rallies” type of market, as monetary policy in the United States continues to tighten, which works against almost everything but the US dollar. Furthermore, there have been a lot of scandals and frauds uncovered in the crypto world, and while it has nothing to do with Bitcoin, it certainly is the problem of Bitcoin. As long as confidence is so shaken, Bitcoin has a long hard road ahead of it.