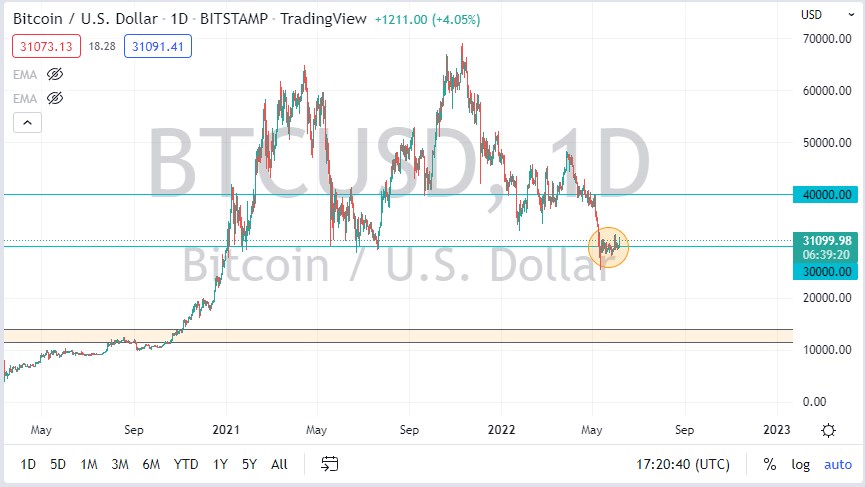

Bitcoin markets have rallied a bit on Monday as the $30,000 level has offered a reasonable amount of support. We have been going sideways for a while, so some traders are using this area as a zone of accumulation, but I think we still have quite a way to go before we can give the “all clear” to go long.

The initial resistance will be found that $32,500, if we cason break above there, we could pick up a little bit more traction. It’s probably worth noting that the 37,500 level could be the target, as it was the scene of the most recent breakdown, which of course is followed very quickly by the $40,000 level, an area that will attract a certain amount of attention.

The biggest problem Bitcoin has at the moment is that risk appetite has been decimated. Keep in mind that all crypto, including Bitcoin, are pretty far out on the risk spectrum, so we need “good times” in order for these markets to rally. That being said, we are a long way from that in any type of significance.

Crypto markets have recently been hammered due to the collapse of Luna and all of the issues that it has brought. There are a lot of concerns about fraud and use case scenarios in crypto, and even though Bitcoin does look like it has a future, it’s being taken down with the rest of it. That being said, anybody who has traded Bitcoin for a reasonable amount of time knows this kind of thing happens, and that crypto is still relatively new. Because of this, you have to be able to ride through a significant amount of volatility.

As things stand right now, I don’t think that you need to rush into the market to start buyingq; you probably have all the time in the world. We are not suddenly going to turn around and shoot straight up in the air, the risk appetite is just not going to be there. In fact, it’s more likely that we will break down below the $28,000 level and go looking towards $25,000, and then $20,000 over the next several weeks. Either way, if you are bullish on Bitcoin you probably have a significant amount of time to build a position.