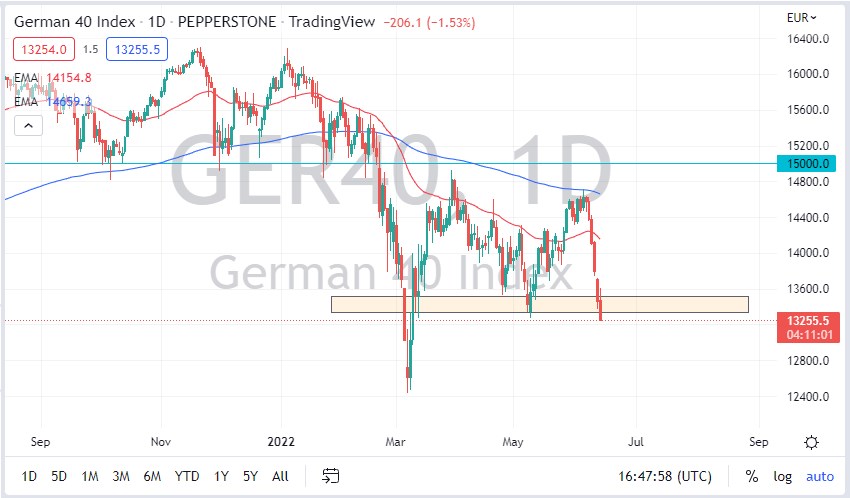

The German DAX Index initially tried to recover a bit on Tuesday but turned around and fell apart. Because of this, the market looks as if it’s ready to take out this support area, which then could see a flush lower. At that point, I would anticipate that the DAX will go looking to reach the 12,500 level over the longer term. It may take a while to get there, but then again, we could see this market fall directly to that level depending on just how much concern there is around the world. Certainly, this is a market that looks very weak, just as most stock indices do right now.

If we do rally, we need to take out the 13,600 level to begin to talk about recovery. Even then, it’s very unlikely that we will recover completely because there are so many fundamental problems with the world economy right now. Ultimately, this is a market that seems as if it will fall given enough time, so I look at rallies as potential selling opportunities. Even if we do take out the 13,600 level, then we could approach the 14,000 level. The 14,000 level is a large, round, psychologically significant figure, and I think a lot of people will be paying attention to it.

Central banks around the world continue to tighten monetary policy, and that is going to cause some issues for several markets. I do not think that the DAX is going to avoid some of the major problems that the rest of the world will deal with, so you should keep an eye on the DAX for some type of “heads up” as to what other indices will do, especially on the European continent. Keep in mind that the DAX is one of the first places that money goes running to when it is heading to the EU. Alternately, if the DAX falls from here, then it’s likely that the MIB, IBEX, AMX, and many of the other smaller European indices will fall right along with it. Be cautious about your position size, but once the floor falls out of this market, it’s probably going to get rather ugly, and once we do break down, I’m probably going to jump all over this potential setup. I have no interest in buying as things stand right now.