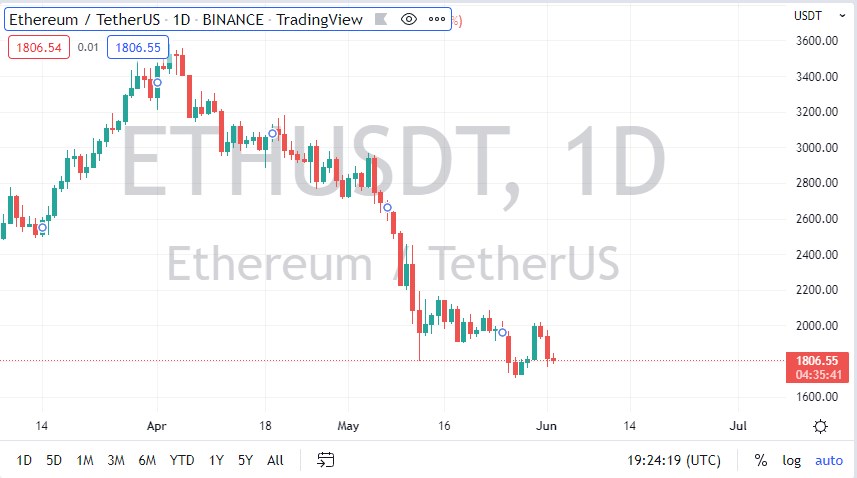

Ethereum has done nothing during the trading session on Thursday as we hang around the $1800 level. This is interesting because it does not seem as if Ethereum has any real shot at going higher, therefore I think what we have here is a situation where eventually we get a bit of a breakdown. This jibes well with the rest of the crypto markets, which quite frankly looked miserable. With that being the case, I believe it is only a matter of time before we see much lower pricing.

Longer-term, I do think that Ethereum has a future, but you are more likely than not going to be able to buy Ethereum at much better prices. We are entering “crypto winter”, which is when crypto does almost nothing for ages and puts everyone to sleep. Eventually, people will look at the possibilities going forward, and start buying crypto again. However, the last time we had crypto winter, it lasted about 3 ½ years. Do not be surprised if it is shorter this time, but at the end of the day, it’s difficult to imagine that we do not go into crypto winter because quite frankly crypto has not found its footing yet. There is no real case use of crypto at the moment, despite the fact that we have been hearing about the possibilities for years. Sooner or later, people get bored with it and get rid of it. The fact that we have seen so much in the way of Ponzi schemes over the last year or two also has trust near zero when it comes to crypto.

If institutional money will not jump into the market, it is difficult to imagine that we are suddenly going to see Ethereum take off. Furthermore, the merge has been horrifically slow, and I read stats just yesterday that 1.3 million transactions failed on the blockchain last month. This is not a good look, and therefore it appears that crypto has years ago before it can be a truly viable technology. If that’s going to be the case, then it makes a lot of sense that cryptocurrency pays the price. That being said, I do believe that eventually, we will find a longer-term slow-moving bottom just like the last time, and it will be a great buying opportunity for the next pump and dump.