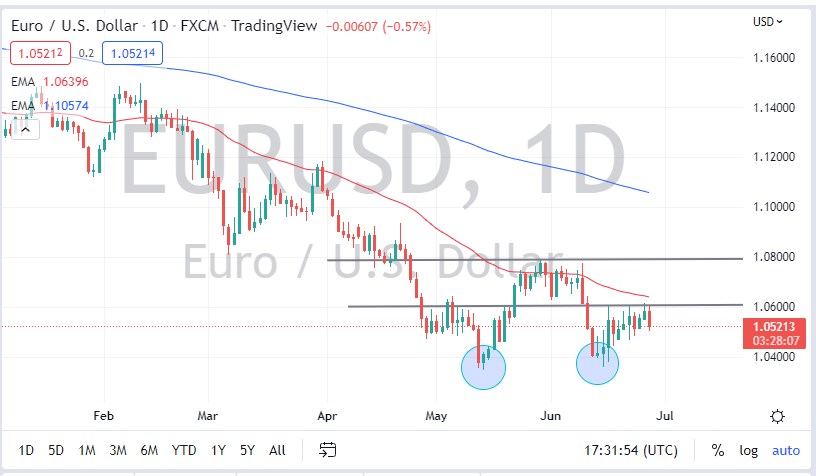

The euro struggled with the 1.06 level for some time, which suggests to me that we are eventually going to roll over. The 50-day EMA sits just above the 1.06 level and is shrinking. At this point, the market is going to continue to see a lot of negativity, and therefore it is more likely than not that we could fall to reach the 1.04 level. The 1.04 level is an area where we had formed a “double bottom” recently, but at this point, it looks like we could try to break down below and test that yet again.

If the market were to break down below the 1.04 level, I think we could open up quite a bit of fresh selling, perhaps sending the euro down to the 1.02 level, and then eventually parity. Parity would be a headline-causing level, and I think a lot of traders are out there are looking to run the euro down to that level. Looking at this chart, it appears that even if we were to break to the upside, there is only so much in the way of real estate that we can cover to the upside.

Breaking above the 50-day EMA, would make it possible to reach the 1.08 level. The 1.08 level is a significant region where we have seen both buying and selling recently, so I do think that we will probably continue to see a lot of selling pressure in that area, so I do not think that the euro will be breaking above there anytime soon. If we were to break above that level, it could change a lot of attitudes. However, I think it will take a massive change overall to make that happen, so ultimately, I am skeptical of rallies. I look at rallies as an opportunity to start shorting again, as the euro has to deal with a very strong US dollar, due to the Federal Reserve tightening monetary policy much quicker than the European Central Bank can even dream of. Because of this, I continue to look at rallies that show signs of exhaustion as interest signals to the downside. I think that the euro will continue to be very choppy, but that’s nothing new for this pair as it tends to be very noisy.