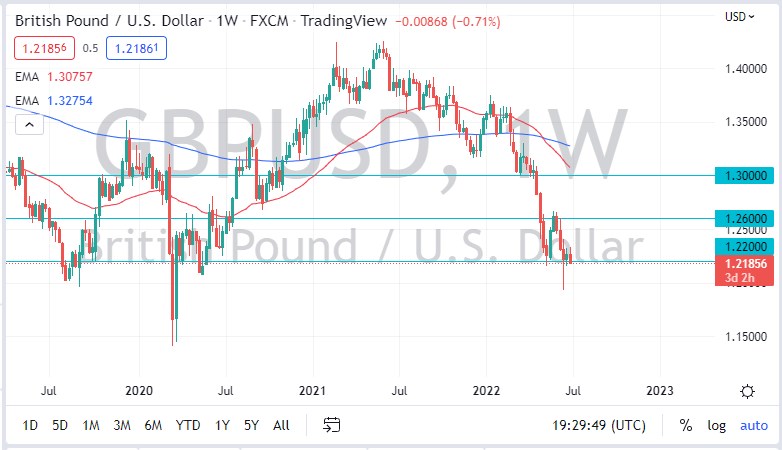

The British pound initially tried to overcome the 1.26 level during the month of June but has since fallen rather significantly. At the end of the month, it looks as if the market is trying to break down below the 1.22 handle, and it’s very likely that we will continue to see downward pressure in this market to make a go looking to the 1.20 level underneath. We had bounced from there previously, so it would simply be revisiting a recent low.

If we were to break down below the 1.20 level, it’s likely that the market could go down to the 1.15 level. This is where the market had bottomed a couple of years ago, so it should be a very interesting target going forward, especially as the area had been defended so vigorously in the past.

The Federal Reserve will be tightening interest rates yet again during the month of July, and the Bank of England might become a bit more hawkish, but they are going to be far behind the curve of the Federal Reserve. That’s going to be the story for the rest of the summer, US dollar strength, so I don’t think that the British pound is going to be any different.

From a technical analysis standpoint, I believe that your ceiling for the month of July under the best of circumstances will be the 1.26 handle, assuming that the British pound can recover a bit. That being said, I would be a bit surprised if we reached that level again, but if we did then I will be shorting this market. If we break above that area, then it’s possible that the British pound could go looking to reach the 1.30 level, but we would need to see something fundamentally change between now and then to make that happen. Perhaps if the Bank of England were to become aggressive in its tightening cycle, that might be a reason, or if the Federal Reserve changes its tone. I don’t see that happening, so at this point, it more likely than not will continue to be a “sell the rallies” type of market for the month of July. Ultimately, this is a market that is trying to chip away at a significant support level, so it may be more sideways during the month of July, perhaps with a bit of a downward tilt.