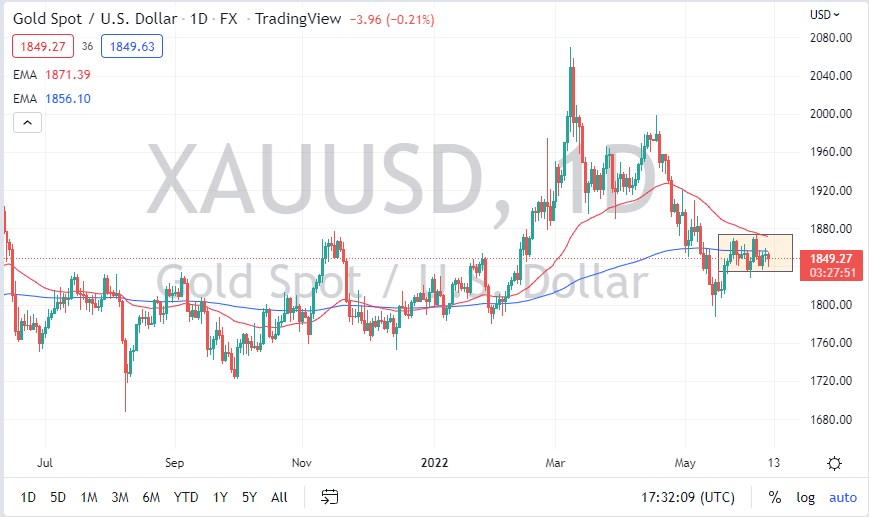

The gold markets initially fell during the trading session on Thursday but then turned around to show signs of life at the bottom of the consolidation area. This is a market that continues to see a lot of noisy behavior, and therefore it’s going to continue to be difficult to deal with until we get through the CPI figure at the very least, due to the fact that the markets are paying close attention to the idea of inflation in the United States, and the Consumer Price Index will give you a “heads-up” as to what the Federal Reserve may have to do to fight inflationary problems.

If we were to turn around and break down below the $1830 level, it opens up a move down to the $1800 level. The $1800 level coincides with the year of the trendline and therefore challenges the entirety of the uptrend. If we break down below there, then it’s likely that the market will fall apart and go much lower. On the other hand, if we were determined to show signs of life, and break above the 50 Day EMA, then it opens up the possibility of a move to the $1900 level, maybe even the $2000 level. Ultimately, this is a market that I think will continue to be noisy, and difficult to manage until we get a little bit of clarity, and perhaps more importantly, momentum.

The next couple of days will probably have a lot to do with where we go next, and at this point, it’s likely that we should see volatility, but it does look like we are trying to compress enough to get momentum into this market and go higher or lower. Keep in mind that the bond markets are trying to price the idea of a more hawkish Federal Reserve, meaning that they are expecting that the CPI numbers will be hotter than anticipated.

I suspect that by the end of the day Friday, we may have a bit of clarity going forward. Until that happens, until we break out of this little box that we are in, it’s difficult to imagine a scenario where you can put a bunch of money into this market. Ultimately, gold markets are going to be heavily influenced by bond yields in America, and of course any comments coming on the Federal Reserve.