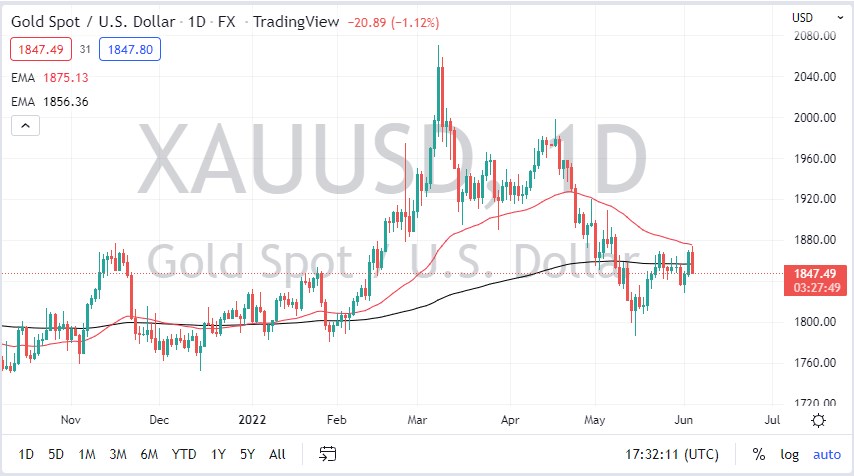

Gold markets initially tried to rally on Friday but found the 50-day EMA to cause resistance. The $1875 level is also sitting right there as well, and it’s interesting to see that gold got hammered after the jobs number in the United States, as interest rates started to pick up. At this point, it looks like the gold market is going to continue to be very noisy, perhaps even falling further to find some type of support underneath.

The $1825 level makes sense as potential support, but even if we break down below there, the $1800 level will come into the picture as well. The $1800 level is a large, round, psychologically significant figure, and an area where there has been previous support. Because of this, I do think that it is probably only a matter of time before the buyers step back out, but in the short term it looks likely that we are going to continue to go a little bit lower.

It is worth noting that the market closed at the very bottom of the range for the day, so it’s likely that the market will see a bit of follow-through. The market is likely to see a lot of noise, but given enough time I also believe that the buyers will eventually return due to the fact that people are going to be jumping back into the bond market, driving those yields back down.

Alternatively, if we were to turn around and take out the $1875 level, then it’s likely that the gold market would go reaching to the $1900 level. The $1900 level was previous support and resistance, and I think that there is a significant amount of market memory there. If we break above there, it’s likely that the market could go to the $2000 level over the longer term. That being said, if the market were to break down below the lows that we just made a couple of weeks ago, then it’s likely that we will go much lower. In that scenario, gold could unravel quite drastically and could accelerate to the downside. At this point though, I think it’s more likely than not that we will find plenty of value hunters over the longer term.