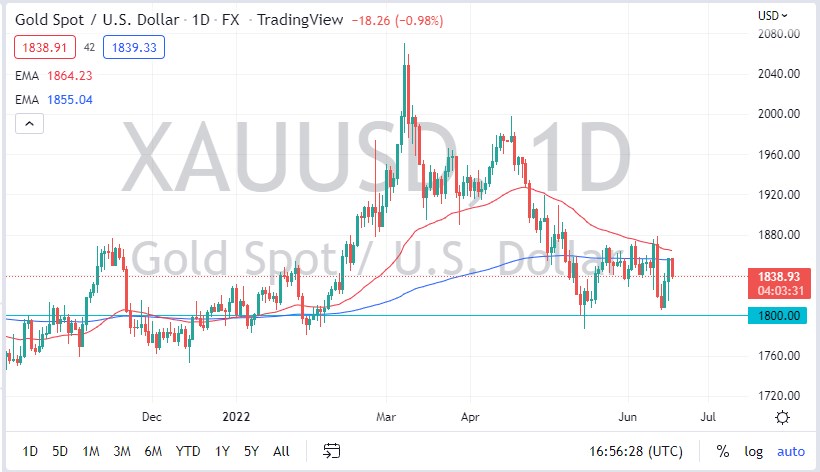

Gold markets pulled back a bit from the 200-day EMA as we continue to see them look very likely to consolidate in the short term. Having said that, it is worth noting that the $1800 level has formed a little bit of a “double bottom”, so that might be worth watching. In fact, I believe that the $1800 level is a significant support level that a lot of traders will be paying close attention to. Because of this, it’s very likely that we will see buyers come into this market to try to take advantage of value somewhere near that vicinity.

As long as we can hold above the $1800 level, the gold markets have a significant chance of recovery. In this scenario, one would have to think that inflation concerns may drive the value of gold higher given enough time, but at the same time, we have high interest rates, which have been working against the gold markets. This is why I think things will continue to be very noisy and choppy, so you cannot get too aggressive one way or the other. You need to let the market tell you where it wants to go.

On the upside, the most obvious barrier that I see right now is the $1880 level. If we were to break above there, then it’s likely that the gold market will go to the $1920 level, and then eventually the $2000 level. This is a big move, and obviously would not happen overnight, but it certainly would capture a lot of attention. With that being the case I think the gold market is one that is trying to set up for a bigger move, but you need to be cautious about your position size until it confirms that type of scenario.

If we break down below the double bottom, then I think the market will look at the $1750 level as the next target. That could be a rather quick drop, probably caused by a massive spike in the US dollar. In fact, pay close attention to the EUR/USD currency pair, because the chart looks almost identical, so one could lead the other in this situation. Regardless, right now it’s all about interest rates in the dollar when it comes to everything, let alone gold.