The losses in the gold market came as dollar and Treasury yields continued to rise ahead of the Federal Reserve's monetary policy announcement scheduled for Wednesday. The Federal Reserve is widely expected to raise the US interest rate by 50 basis points. In this regard, Goldman Sachs and JPMorgan Chase & Co. said they expect the Fed to raise interest rates by 75 basis points.

The accompanying statement from the US central bank is expected to provide clues about future interest rate hikes and policy stance.

After that, the Bank of England is expected to raise interest rates by a modest 25 basis points on Thursday despite data on Monday showing a contraction in the country's GDP in April. The yield on the 10-year US Treasury bond rose to about 3.45%. The dollar index rose to a two-decade high of 105.46 today.

As for US economic data today, data from the Labor Department showed US producer prices rose 0.8% on a monthly basis in May 2022, after rising 0.4% in April. The producer price index for final demand, excluding food and energy, rose 0.5% from the previous month in May 2022, accelerating from a downwardly revised 0.2% increase the previous month. On an annual basis, core producer prices rose 8.3%, down from a revised 8.6% increase in April.

Annual product inflation in the US fell slightly to 10.8% in May 2022 from 10.9% in April and a 21-year high of 11.5% in March. On the other hand, according to a report issued by the National Federation of Independent Business, the NFIB Small Business Optimism Index in the United States fell to 93.1 in May of 2022, the lowest level since April of 2020, compared to 93.2 in April.

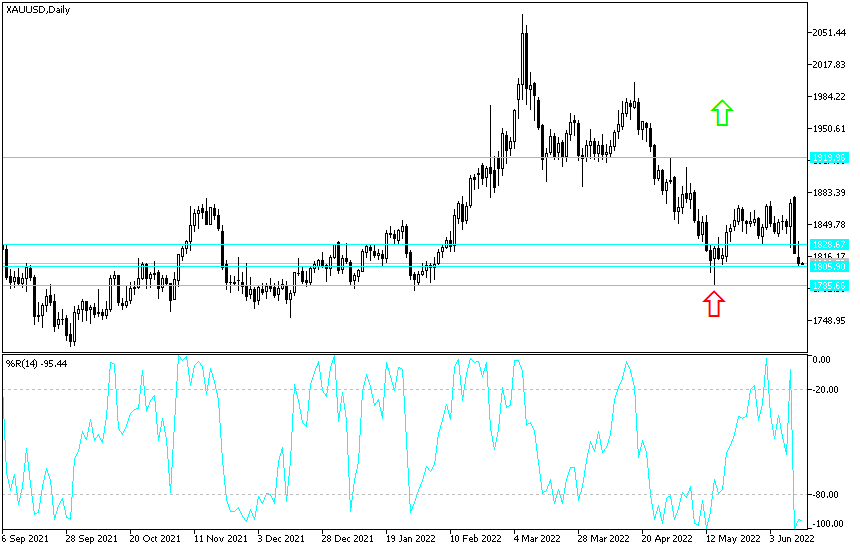

According to the technical analysis of gold: There is no doubt that the movement of the price of gold towards the psychological support of 1800 dollars per ounce supports the control of the bears and the change of the direction of gold to a bearish one. Gold investors are preparing for new buying levels, and I see that the support levels of 1778 and 1760 dollars, respectively, are the most appropriate to think about that. The recent losses pushed the technical indicators towards oversold levels. The price of gold may remain under downward pressure until the reaction from monetary policy decisions of the US Federal Reserve and the statements of its governor, Jerome Powell. Indications of the future of raising the US interest rate will have a strong reaction on the US dollar, and therefore the price of gold.

On the upside, the price of gold needs to return to the vicinity of the resistance levels of 1828 and 1845 dollars, respectively, for the bulls to return to the launch.