With the return of the strength of the US dollar, XAU/USD gold prices were subjected to quick selling operations. The price of the yellow metal pushed to the support level of 1818 dollars an ounce and is stable near it at the beginning of trading today, Wednesday. The most active gold futures rallied to their lowest closing level in two weeks, amid prospects of violent policy tightening by the Federal Reserve to combat inflation.

In general, the strong dollar has affected gold prices. The dollar index, which rose to 104.61, retreated from this high level later, but is still steady at 104.51, up 0.55% from the previous close. On the other hand, the easing of Covid-19 restrictions in China helped limit the decline in the price of gold. China cut the mandatory quarantine period for incoming travelers in half, in the biggest easing of entry restrictions after sticking to a strict policy on the coronavirus during the pandemic.

The easing of the country's "zero COVID" policy came after Beijing and Shanghai reported no new local COVID-19 infections for the first time in months.

A report from the Conference Board showed that US consumer confidence deteriorated to its lowest level in more than a year in June. The Conference Board said the US consumer confidence index fell to 98.7 in June from a downwardly revised 103.2 in May. Economists had expected the index to fall to 101.0 from originally 106.4 for the previous month.

As the decline continued, the US Consumer Confidence Index fell to its lowest level since it reached 95.2 in February 2021.

Meanwhile, in a speech at the European Central Bank Forum on Central Banks in Sintra, Portugal, European Central Bank President Christine Lagarde played down fears of a recession in the eurozone. Lagarde said: “We have significantly revised our growth forecast for the next two years. But we continue to expect positive growth rates due to the domestic buffers against losing growth momentum.”

On the other hand, it affected the market sentiment. The G7 nations will decide to develop mechanisms to cap global prices for Russian oil on shipments to countries outside the United States, the European Union, the United Kingdom, and the broader Group of Seven. Accordingly, a senior Biden administration official said in a press call prior to that: “The goal here is to starve Russia — to starve Putin of his main source of cash and impose the price of Russian oil to help mitigate the impact of Putin’s war on the pump.”

The G7 leaders are discussing the Ukraine issue. For his part, Ukrainian President Volodymyr Zelensky, in his speech to the G7 summit via video link, called for more weapons to be provided to his forces to fight their Russian counterparts. He told the leaders of the world's seven largest economies that he wanted the war to end by the end of the year "before winter comes."

As part of a coordinated G7 announcement on Tuesday, the leaders are expected to issue a statement in support of Ukraine, which will include significant new sanctions on Russia to intensify the economic pressure on that country. The summit will also announce a major commitment to help Ukraine cover its short-term budget shortfalls, including $7.5 billion from the United States from the recently passed Annex II. President Biden and the entire team here are working around the clock to take advantage of the fact that nearly 50 percent of the world's economy is in one place and do more to support Ukraine, hold Russia to account, and manage Putin's influence. The goals of the G7 leaders were to directly target the revenues of the Putin regime, particularly through energy, and to minimize the repercussions and impacts on the G7 economies and the rest of the world.

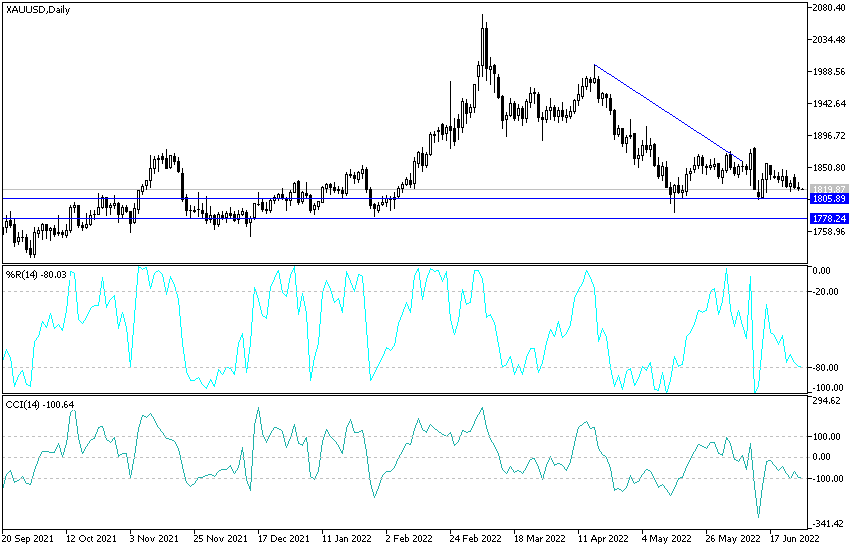

Today's XAU/USD Gold Market Outlook:

Despite the recent performance, my outlook for the future of the gold price is still optimistic as long as it is stable above the resistance of 1800 dollars an ounce. I still prefer buying gold from every descending level and the closest levels of buying gold are 1810, 1785 and 1770 dollars, respectively. On the upside and according to the performance on the daily chart below, the resistance levels of $1855 and $1877 will be important for a stronger and continuing control of the bulls over the direction of gold.

The price of gold will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the announcement of the growth rate of the US economy and the statements of monetary policy officials by both Federal Reserve Governor Jerome Powell and European Central Governor Lagarde.