Solana tried to rally early on Monday but pulled back as we continue to see this market drift lower. This is no different than anywhere else in the crypto world, as we continue to see money flow away from it. We are in “crypto winter”, meaning that the markets are going to do very little but maybe drift lower for quite some time. Risk appetite has been destroyed, as we have seen central bank policy shift rather drastically.

This is a bit ironic, considering crypto is supposed to operate outside of the world of traditional finance. However, it looks as if crypto needs all of the same things that traditional finance does, and when you think of Solana, you should think of something like a mid-cap stock, as it is relatively well known and traded. But at the end of the day, it’s not necessarily something along the lines of Bitcoin. It is still speculative, even by crypto standards, although there are many more speculative coins out there.

Solana certainly looks as if it probably has some type of future, but it is a competitor to Ethereum, and therefore it will probably always play second fiddle to that ecosystem. In a scenario where crypto is considered to be toxic, brand-name recognition is a huge benefit. Because of this, I think Ethereum will continue to outshine Solana, perhaps for the next few years, perhaps forever.

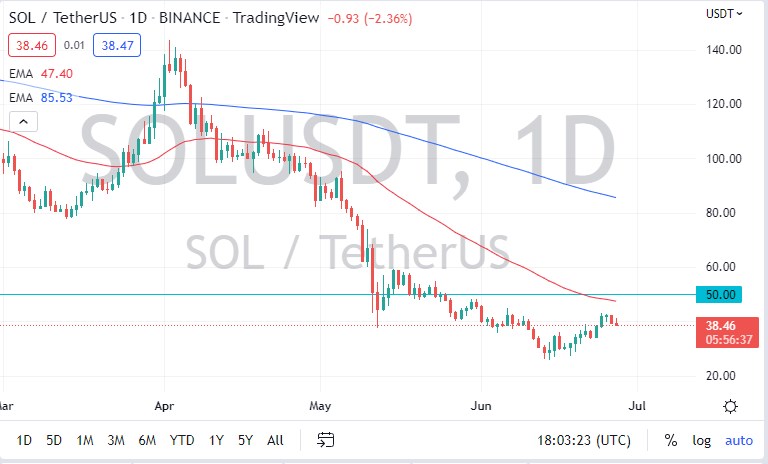

The $20 level is the next major level on longer-term charts that I am paying attention to, and I do think that’s where we eventually end up. Ultimately, Solana will bottom, but where that is going to be is hard to tell because the markets quite frankly have seen so much damage. This is the type of damage that can go on for months or years, so I don’t think that there’s any reason to be buying Solana anytime soon. In fact, at the very least, Solana would have to break above the $60 level to look remotely interesting. That would be a gain of 50% from the current price, something that is not easily done. Because of this, I think Solana should be thought of as dead money, or perhaps something that you can buy down the road at a much cheaper price and start to accumulate again for the next ball run.