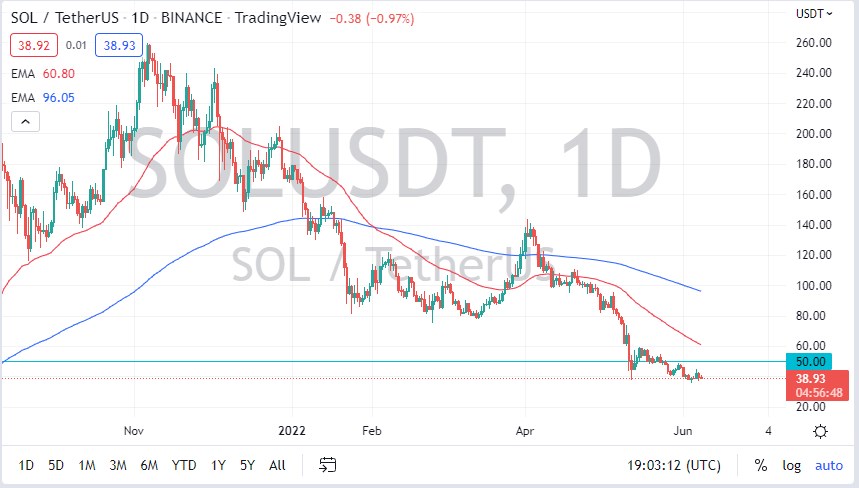

Solana did very little on Wednesday, which is a bit impressive considering just how negative it has been previously. After all, if it cannot find buyers down here to get something positive going, the question then becomes whether or not it ever will? Obviously, it could but Solana has been extraordinarily bearish for quite some time, and I just don’t see how this changes. The market is now threatening the $40 area and has already broken below it.

Looking at these last couple of months, we have formed a nice descending triangle, measuring $20. At this point, it looks like Solana will go looking to the $20 level on a breakdown. At this point, we would have to look at the previous action in the area, as it was so important. This would be a complete “round-trip” for the Solana market, something that even Bitcoin is threatening to do if it breaks down through a few small levels. Crypto is dead in the water at the moment, so unless you are a longer-term investor, there won’t be anything to do with Solana and other coins.

The market would have to break above the $60 level, meaning gain 50% for it to be even remotely close to flipping to bullish. That being said, I suspect the most likely situation will be that we go down to the $20 level, and then drift a little lower than that where we go sideways and wait to see whether or not Solana sees any type of significant adoption. Crypto is a complete dumpster fire at the moment and will continue to be for the next several months, if not years. You need to see other markets such as Bitcoin and Ethereum turn around before you can even remotely consider Solana.

That being said, I’m not completely against the idea of buying some Solana after it breaks down again, and then slowly building a bit of a position. After all, if you can buy it at $20, and it turns around to reach the highs again, it would be a 10-bagger. I have no idea how long that would take, but obviously, it is something that you can think about. You also have to recognize that Solana is very speculative as all crypto is, so never speculate with money you can’t afford to lose.