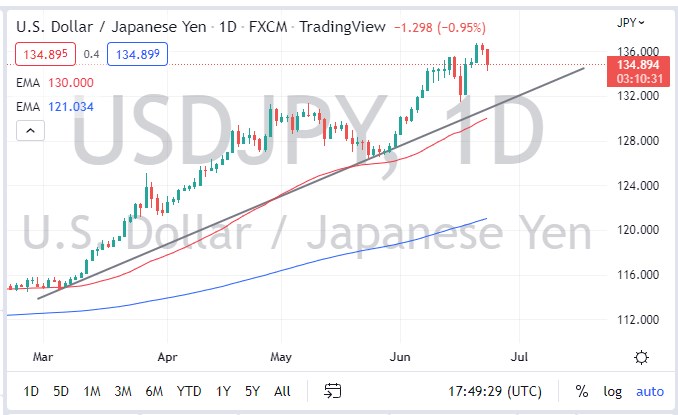

The US dollar has fallen from the ¥136 level, reaching below the ¥135 level during the day on Thursday. That being said, the market still looks very bullish from a longer-term standpoint, and therefore I think that we will continue to see buyers trying to pick out the value when it’s offered. After all, the US dollar is by far the most desired currency at this point, so therefore it’s likely that it will eventually attract inflows.

Keep in mind that the Bank of Japan continues to do everything it can to keep interest rates down, and therefore has been essentially “printing yen.” That being said, the market is punishing the currency for that. Furthermore, you have the Federal Reserve doing everything it can to fight inflation, and that means monetary tightening. In a monetary tightening cycle, the currency typically appreciates, and that’s exactly what we have seen in multiple currency pairs. Ultimately, it makes sense that every time we pull back, buyers will jump into the market and start buying. That’s exactly what’s going on right now, and it seems as if the uptrend line also comes into the picture as well. What’s even more interesting is that the 50 Day EMA is crawling right along with that trendline as well.

On the upside, if we were to make a fresh, new high, then it’s likely that the market will go looking to reach the ¥137.50 level, and then eventually the ¥140 level. This is a market that has been very strong for quite some time, so the occasional pullback does make a certain amount of sense, as we are trying to work off some type of froth in this overbought condition.

Pay attention to what the Bank of Japan has to say because if they were to change their plans, it will almost certainly cause this market to crash. The Federal Reserve changing its plans also could have that happen as well, and therefore you need to pay attention to them also. That being said, Jerome Powell had a meeting in front of Congress this week, in which she reiterated the plans for the Federal Reserve to remain relatively tight. Because of this, this is a market that I think you cannot sell, and you have to look at these pullbacks as potential value opportunities.