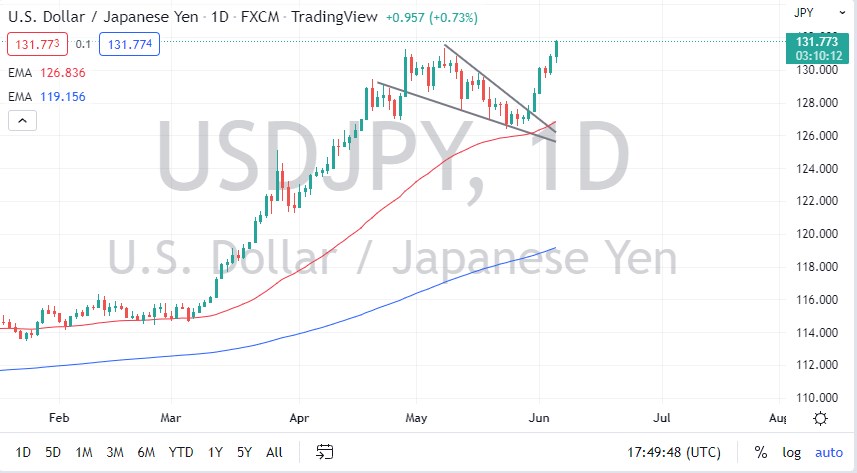

The US dollar rallied significantly on Monday to break to a fresh, new high against the Japanese yen. As you can see on the chart, I had a falling wedge drawn, and now we have broken to reach that target. At this point, it now becomes a question of how high can we go? I think at this point, ¥135 is very possible.

The Bank of Japan continues to work against the value of the yen by fighting interest rates rising in that country. By essentially saying that they are going to buy as many bonds as possible to keep the 10-year below 0.25%, which sets up the evisceration of the Japanese yen. Ultimately, other banks around the world continue to tighten monetary policy, so this is a “one-way trade” that continues to run unchecked. Ultimately, every time this market pulls back we would have to assume that there is a significant amount of buying interest underneath.

The 50-day EMA sits above the ¥126 level and is rising, and I believe at this point that would be the “floor in the market” if you had to have one. The US dollar is particularly strong in general, as it is considered to be a safety currency, and the Federal Reserve is one of the tightest and most hawkish banks in the world right now. That being said, all you have to do is look at any yen-related pair and see how almost any currency will enjoy strength against it.

Until the Bank of Japan changes its tune, there’s absolutely no chance of the yen gaining strength over the longer term. Yes, there may be the occasional pullback, but those pullbacks will end up being buying opportunities as we have seen a couple of times already. The pair is one that everybody is piling into at the same time so that almost certainly assures that it will continue to attract plenty of value hunters every time it dips. This is especially true in this one particular market, as the US dollar is so sought after by people around the world right now anyway. With that being said, I have no interest in trying to short this market anytime soon. The interest rate differential should continue to expand, and the pair should continue to rise.