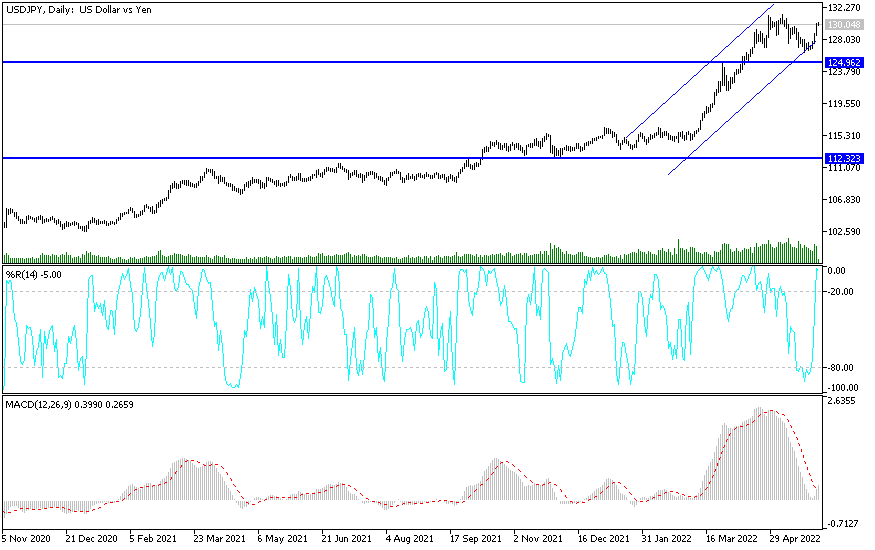

Looking at our technical analyses and regarding the future price of the USD/JPY currency pair, we often recommended buying the currency pair from each descending level. These recommendations come despite the continuation of the recent selling operations, reaching the support level 126.35. The pair returned, as we expected, to rebound higher with quick gains to the level of resistance which is 130.24 in early trading today, Thursday, by about a quarter of 400 points from our purchase recommendations. We stressed that the future of raising US interest rates throughout 2022 will be a catalyst for the dollar-yen pair to rebound higher again.

Before the announcement of the most important US economic data today and tomorrow. Severe demand for American workers slowed slightly in April, although the number of job vacancies remains high, and companies are still desperate to hire more people. Yesterday, the US Department of Labor announced 11.4 million jobs at the end of April, down from about 11.9 million in March, the highest level in records in more than 20 years. At this level, there are approximately two vacancies for every unemployed person. This is a sharp reversal of the historical pattern: Before the pandemic, there were more unemployed people than there were available jobs.

The number of people who left their jobs remained near record levels at 4.4 million in April, most of them unchanged from the previous month. Nearly all of those who leave work do so to take on another job, usually for a higher pay. The historically large number of vacancies and the number of people who are independent of work has forced employers to pay more to attract and retain employees. These trends are driving strong wage gains for American workers, especially those who change jobs.

The numbers also indicate that US employment remains strong. Tomorrow Friday, the government will release the monthly US jobs report. Economists believe employers added 323,000 jobs in May, and that the unemployment rate fell to 3.5%, matching its lowest level before the pandemic, from 3.6%.

According to the technical analysis of the pair: On the daily chart, the price of the USD/JPY currency pair broke the 130.00 psychological resistance, the importance of a stronger and continuous control for the bulls on the trend. It increases expectations of a return to the path of the stronger bullish launch, as it was at the beginning of last month's trading, as the currency pair jumped to the resistance level of 131.35, the highest in 20 years. On the other hand, and over the same time period, the breach of the support levels 128.60 and 127.35 will be important for the bears to dominate again, and so far, I still prefer buying the dollar yen from every descending level.

The dollar-yen pair will react today with the extent to which investors are taking risks or not, as well as the reaction from the announcement of the first releases of the US labor market ADP to the change in non-agricultural employment, weekly jobless claims, non-farm productivity rate and US factory orders.