This is near the highest in 24 years. The gains of the trend brought it to the resistance level of 136.71 last week, which increased expectations of the possibility of moving towards the historical resistance level of 140.00. This can happen as long as the US Federal Reserve maintains its direction towards more US interest rate hikes strongly during 2022.

In general, expectations of a rise in interest rates in major central banks may have peaked, which may mean that the money and forex markets have witnessed an important turning point. More importantly, this has pushed some analysts closer to a “peak dollar.” A look at money market pricing suggests that peak expectations for the number and number of increases from the Fed, European Central Bank and Bank of England may have been reached last week.

Reuters data shows a continuing rebound in investor expectations of the amount of tightening that will come from central banks. A peak of the Fed's federal funds rate is now seen at 3.4%, down from 4.1% prior to the Fed's recent policy. The turnaround was supported by surprisingly weak PMI data out of the US on Thursday which lowered US bond yields, weakened the dollar, and rallied stock markets.

The ECB's peak rate is now seen at 1.8%, down from the 2.6% peak seen last Tuesday, also supported by disappointing Eurozone PMIs. Meanwhile, the Bank of England is expected to push interest rates as high as 3.0%, down from 3.6% last Monday.

This shift in expectations reflects lower yields on government bonds.

French and German 10-year bond yields fell by 20 basis points in the wake of the recent disappointing PMI data, in contrast, British bond yields fell by 12 basis points as UK PMIs defied expectations as they came in stronger than expected . This provides a convincing explanation for the appreciation of the pound against the euro in the wake of the PMIs.

The US dollar has been the main beneficiary of rising interest rate expectations, with the Federal Reserve leading the charge in higher inflation while grappling with rising inflation in the US. Raising interest rates only pushes inflation down because it slows economic growth. Rising fears of slowing growth, which could lead to a recession, in turn dampened investors' expectations.

Thus, the bet is that the Fed will make more violent rallies in the near term and then finish its cycle before lowering again. Because other major central banks cannot be left behind by the Federal Reserve, they will follow a similar path. Until expectations of a rate hike turn higher again, the US dollar may struggle to build upward momentum, allowing the British Pound, Euro, and other currencies to recover.

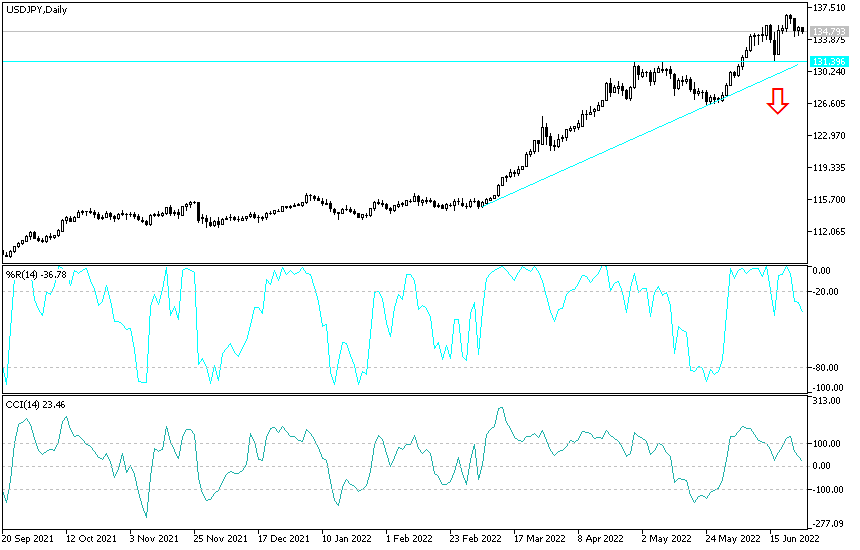

USD/JPY Analysis:

The control of the bulls on the general trend of the USD/JPY currency pair is still valid and continuing. The return of the move towards the resistance 136.70 will re-talk in the markets about the possibility of moving towards the historical resistance 140.00. Officials in Japan have identified as the level that deserves them to intervene to prevent further collapse of the Japanese yen. The recent and continuous gains undoubtedly pushed the technical indicators towards overbought levels, but the strength factors continue.

On the other hand, in order for a first breach of the trend to occur, the bears must move towards the support levels 133.20 and the psychological support 130.00, respectively. Today, the dollar will be looking forward to the release of durable goods orders and pending US home sales.