Despite the announcement of a stronger-than-expected contraction of the US economy, forex traders ignored the statement and continued to react to the collapse of the Japanese yen rate in the exchange market. Accordingly, the USD/JPY currency pair moved towards the 137.00 resistance level, the highest for the currency pair in 24 years. This rebound contributed to the strength of expectations that the currency pair could move towards the next historical psychological resistance 140.00 in the coming days. Especially since the factors of the strength of the US dollar are continuing and increasing. This is led by the prospect of a strong tightening of the US Federal Reserve's policy throughout 2022.

According to the results of US economic data, the US economy contracted at an annual pace of -1.6% in the first three months of 2022, the government said, down slightly from its previous estimate for the January-March quarter. It was the first drop in GDP - the broadest measure of economic output - since the second quarter of 2020, in the depths of the COVID-19 recession, and followed strong growth of 6.9% in the final three months of 2021. Inflation reached its highest level in 40 years old, and consumer confidence is declining.

Last month, the Commerce Department had estimated first-quarter GDP growth at 1.5%. But in its third and final estimate on Wednesday, the administration said consumer spending - which accounts for about two-thirds of economic output - was much weaker than it had previously calculated, growing at an annualized pace of 1.8% instead of the 3.1% it estimated in May. This was partially offset by its audit of trade inventories. The reduction in restocking of the company's shelves slashed less than 0.4 percentage points from growth in the first quarter, down from 1.1 percentage points in May, the ministry said. However, a negative GDP number likely does not signal the beginning of a recession, and economists expect growth to resume later this year.

The first-quarter decline says little about the economy's underlying health: a larger trade deficit - which reflects Americans' appetite for foreign goods and services - cut 3.2 percentage points from the change in gross domestic product in the January-March period. Business investment has grown healthily by 5%. However, the US economy, which has enjoyed a quick recovery from the short and devastating recession in 2020 due to the Coronavirus, is under pressure as the Federal Reserve raises US interest rates to rein in inflation that has reached its highest levels in 40 years.

The recovery surprised companies, and the unexpected surge in customer orders flooded factories, ports and shipping yards, leading to shortages, delays, and price hikes. And in May, consumer prices rose 8.6% from a year earlier, the biggest year-over-year jump since 1981.

In response, the Fed accelerated its plan to raise interest rates, raising the benchmark short-term rate by three-quarters of a percentage point, the largest increase since 1994. The Fed hopes for a so-called soft landing — slowing economic growth just enough. To bring inflation down to its 2% target without causing a recession. Rising borrowing costs are already putting pressure on the housing market. For the full year, the economy is still expected to turn into respectable growth: 2.5%, according to the World Bank.

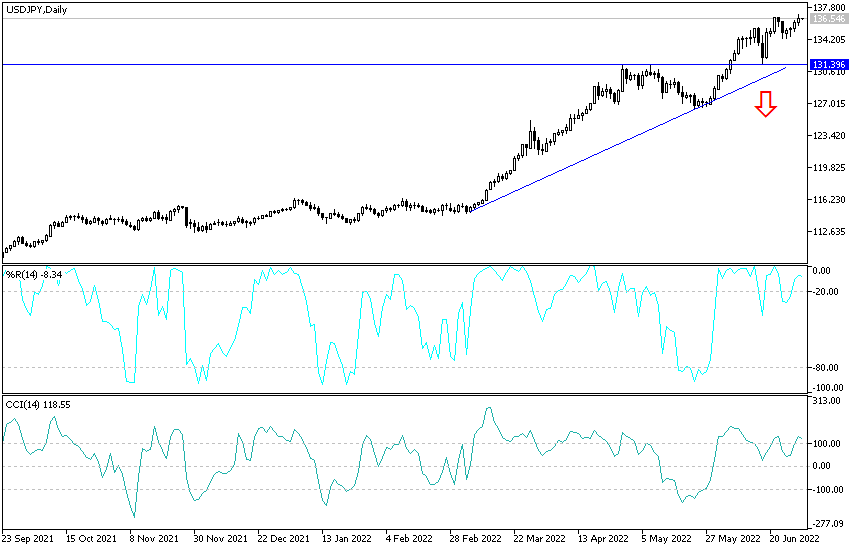

Forecast of the dollar against the Japanese yen:

The general upward trend of the USD/JPY pair is getting stronger, and the bulls are aiming towards the historical peak of 140.00 within their target range. The current currency pair’s gains factors have continued, and we expect them to continue for a while. This may include profit-taking at any time, as the technical indicators moved towards overbought levels. On the other hand, the current trend will not be broken without bears moving towards the 130.00 support level, as is the performance on the daily chart below. The US dollar will react today with the announcement of the US central bank's preferred inflation reading and the personal consumption expenditures price index.