The US dollar initially tried to rally during the trading session on Tuesday to reach the 1.38 handle against the Singapore dollar. However, the market has pulled back rather significantly during the trading session, as interest rates in the United States initially jumped above 3%, and then fell rather drastically. This is a market that is very volatile in general, and the USD/SGD is going to behave just as many of the other markets around the world.

The US dollar has enjoyed a lot of strength as of late, but the Singapore dollar has been even stronger. It will be interesting to see this plays out but currently, it appears that a lot of money in Asia is running toward Singapore for safety. The Singapore dollar can be thought of like the “Swiss franc of Asia”, so therefore it does behave quite a bit like the franc.

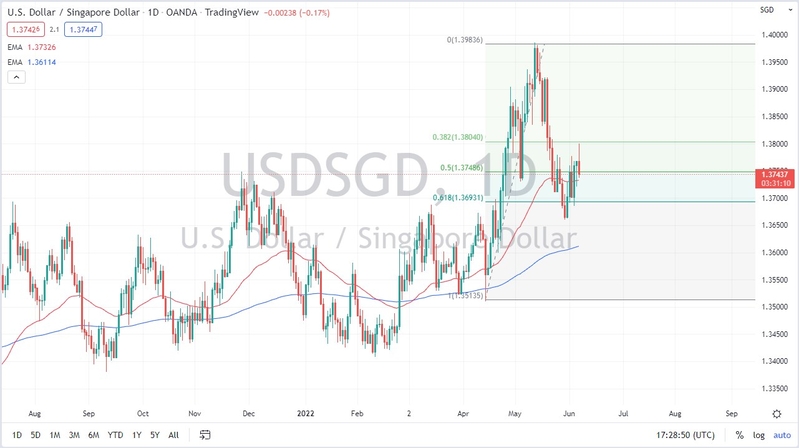

I believe it this point it’s likely that we will continue to see a lot of noisy behavior overall, and therefore I think we are going to reenter the previous consolidation area, between 1.3666 and 1.3766. The 50 Day EMA sits right in the middle of that, and the 61.8% Fibonacci retracement level is also in the midst of all of this noise as well.

Keep in mind this pair typically does not move rapidly, so it’s not a huge surprise at all to see it chop around. The selloff had been rather brutal previously, but if the US dollar continues to see a lot of upward momentum and other currency pairs, one would think that it is only a matter of time before we see it here as well.

If we were to break down below the 1.3650 level, then the USD/SGD pair will test the 200 Day EMA, which is currently just above the 1.36 level. If the market was to break down below there, then it signifies a longer-term downtrend could be forming. If that’s going to be the case, then you need to look around the world to see how the greenback is behaving, because you may see it sell off against everything else as well. It’s worth noting that this pair does tend to “buck the trend” when it comes to the greenback at times, so pay attention.