Today's recommendation on the lira against the dollar

Risk 0.50%.

The buy trade of Thursday was activated and reached the stop loss point

Best selling entry points

- Entering a short position with a pending order from 17.11 levels

- Set a stop-loss point to close the lowest support levels 17.26.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 16.40.

Best entry points buy

- Entering a buy position with a direct order from 16.58 . levels

- The best points for setting the stop loss are closing the highest levels of 16.32.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 17.00

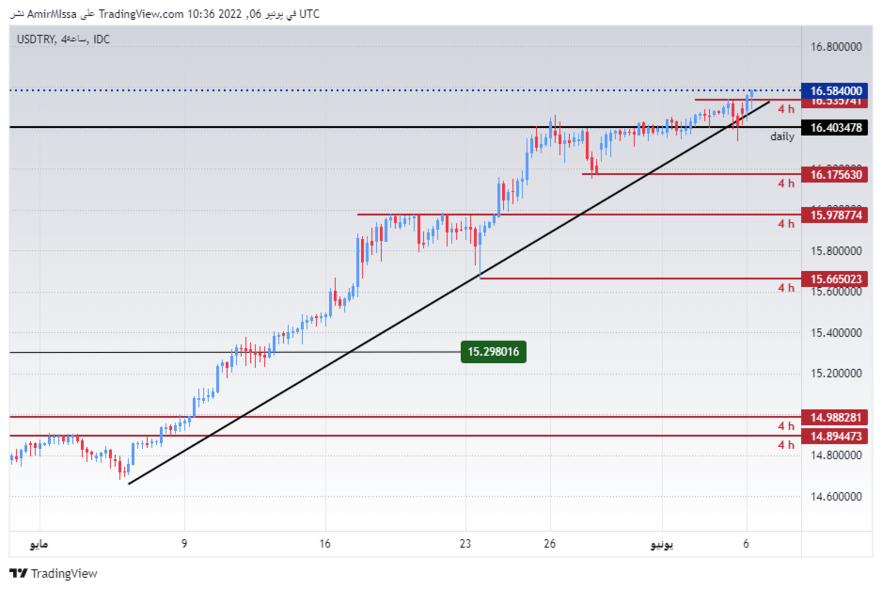

The Turkish lira returned to record new losses against the US dollar after data during the past week showed that inflation in the country rose to its highest level in nearly a quarter of a century. The lira stabilized for two days in an itch that analysts attributed to the intervention of the Turkish Central in the markets before returning to decline again during this morning, as the Turkish currency is approaching its lowest levels during the past year, as it recorded a decline during the current year by 20%, to become the worst performing currency in 2021. Turkish President Recep Tayyip Erdogan on the inflation data for the month of May that inflation has reached its highest levels and is on the way to decline. Meanwhile, press reports quoted Turkish Finance Minister Nureddin Nabati's statements at the ruling Justice and Development Party meeting at the end of last week that no decision has been taken to raise or lower interest rates in the near term.

On the technical front, the Turkish lira fell against the dollar to its lowest level this year during today's trading. The lira surpassed the main resistance levels at 16.40. The pair also continued trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. Referring to the general upward trend, the pair also maintained its trading above the bullish trend shown on the chart. At the same time, the pair is trading the highest levels of support, which are concentrated at 16.40 and 16.00 levels, respectively. On the other hand, the lira is trading below the resistance levels at 17.11. We expect the lira to continue to decline, especially after the pair closed above the 16.40 resistance levels. Each pullback on the pair represents an opportunity to buy back. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Chart generated by TradingView

https://www.tradingview.com/x/tIqIopiX/