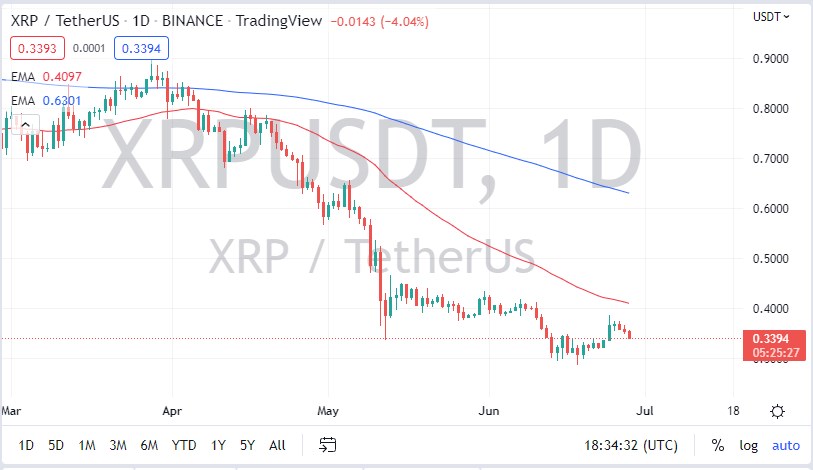

Ripple struggled again on Tuesday, losing over 4%. At this point, Ripple is threatening the $0.33 level, and it looks likely to break down to test the $0.30 level in the next couple of sessions. Ripple continues to struggle right along with the rest of crypto, which is currently in a huge state of disaster. After all, there have been a lot of questions about fraud and viability, so money in general has run away from crypto over these last several months.

When you look at the crypto market, it’s clear to see that we are heading into a situation much like 1999 for technology stocks. We are about to see a lot of coins and markets disappear, but that is not necessarily a bad thing. After all, the quicker we get through getting rid of unprofitable ventures, the quicker we are going to see some type of massive bullish run, not only for pricing in the markets but for the use case scenario.

Ripple is a bit of an outlier in the sense that there are banks that use it for cross-border transactions already. However, it should also be noted that the SEC is still currently fighting Ripple in the courts, trying to determine whether it is a security or not. That being said, if the SEC ends up winning the court case, the CEO of Ripple has suggested that they would leave and abandon the United States altogether. In other words, it would be a banking token that is ignoring the most profitable and lucrative economy in the world. That is not a bullish argument, although it does not necessarily mean that Ripple has to completely disappear either.

With a backdrop like that, if Ripple starts to rally, you can guarantee that quite a bit of other markets is doing the same. This is because not only does Ripple suffer at the hands of risk appetite like the rest of crypto, it is also one that has that specter of a lawsuit hanging over it. Nonetheless, the market could really take off to the upside if and when it gets a decision, assuming that it is not fatal doing business in the United States. There are much easier ways to make money in crypto, and certainly much safer ones than Ripple is currently offering.