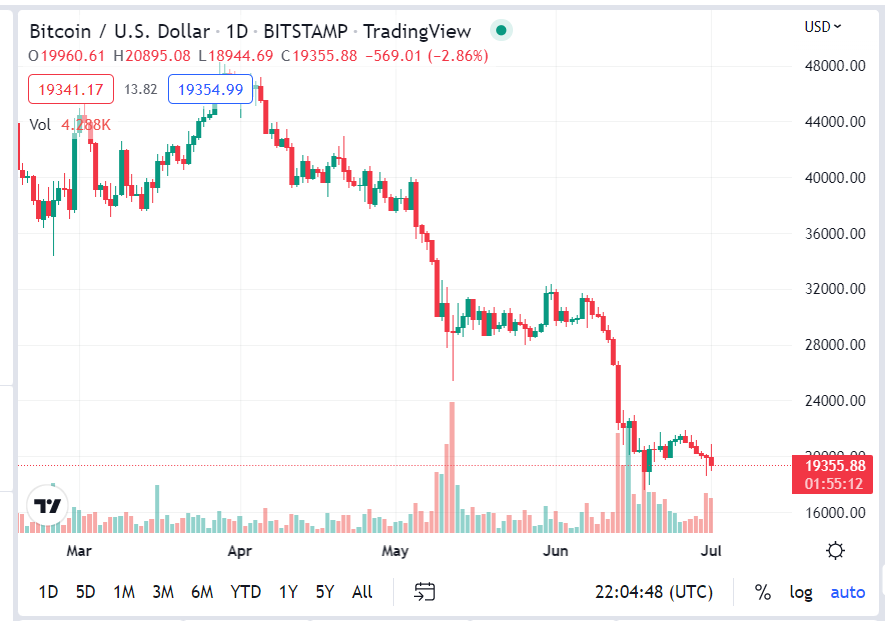

Bitcoin struggled again Friday after initially showing a bit of promise. Ultimately, this is a market that is going to continue to drop, and I suspect that the $18,000 will give way sooner or later. When it does, it’s very likely that we will flush much lower, with an initial target of $16,000.

After that, the market will go looking to the $12,000 level, where a lot of people are looking to get involved. I suspect that is probably about as far as we will go to the downside, but given enough time the best case scenario for most of market participants is going to be that we go sideways for a while, allowing you to pick up bits and pieces in order to build a larger position size.

This is exactly what happened last time during the “crypto winter” a few years ago, which then saw this market break above $60,000. It took a lot of effort, but we eventually did turn things around. This is the first time that Bitcoin has had to deal with a tightening monetary policy, and it has completely failed. Because of this, we will need to see the Federal Reserve change its overall attitude before any real strength can be found.

If we did break above $22,500, it would allow for short-term relief rally. More likely than not, there will be plenty of people waiting to short this market again, so that’s probably my play. It’s not until we break above the $32,500 level that I would be convinced we are going higher. Fading rallies will continue to be the best way to play this market, as it has no real fundamental reason to go higher.

I do think that eventually it will become bullish again, but that might be a story for 2025 or so. It would not surprise me at all to see this market do very little for a year or two, just like it did the previous time. With this, you can be an accumulator at lower levels, but you have all of the time in the world. The only thing that could change this is if the Federal Reserve loosens its monetary policy again. Some traders are hoping that will happen early next year, but inflation has to be kept under control.