- Gold futures are trading at their lowest in more than nine months, driven by another rally in the US dollar.

- The yellow metal, as well as the broader commodities market, has also been hit hard in recent sessions, despite inflation fears and growing fears of a recession.

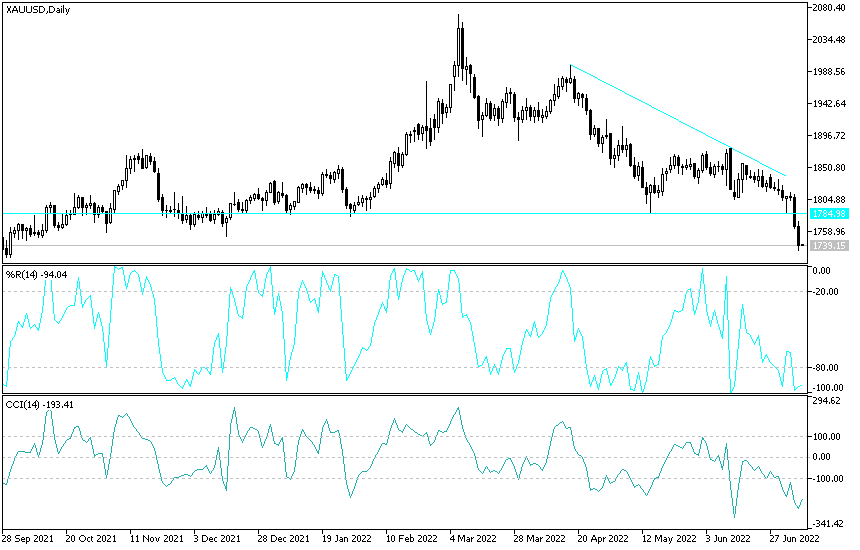

- The price of XAU/USD gold fell to the support level of $1733, the lowest since last September. It settled around the level of $1739 at the time of writing the analysis, waiting for any news.

All in all, the XAU/USD gold price has fallen by about 5% over the past month, bringing its 2022 year-to-date performance to -3.84%.

In the same way, prices of silver, the sister commodity to gold, fell to their lowest level in two years to $19.20 an ounce. And the price of the white metal crashed this year, and it has fallen by 18% since the beginning of 2022 to date. The key factor for the metals market is the strength of the US dollar, says Jim Wyckoff, chief analyst at Kitco. Metals continue to falter from a stronger US dollar index that reached a 20-year high this week. The near-term technical charts for gold and silver are completely bearish, which also prompts technically acclaimed traders to play the short sides of the futures markets.

In fact, the US currency was on a tear, especially in the first two trading sessions of the week. The US Dollar Index (DXY), which measures the performance of the US dollar against a basket of currencies, rose again by 0.55% to 107.12, from an opening at 106.54. And from the start of 2022 to date, the index is approaching a gain of 12%. A strong dollar is bad for dollar-priced commodities because it increases the cost of buying them for foreign investors. The prospect of higher US interest rates weighed on the bond market, although yields took a midweek break.

The US Treasury market was in a general decline, with the 10-year bond yield dropping 4.9 basis points to 2.762%. But the real story is that two-year and 10-year bond yields have reversed, with the former trading at 2.784%. The price of gold is usually sensitive to a price environment because it raises the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures rose to $3.4245 a pound. Platinum futures jumped to $853.50 an ounce. Palladium futures rose to $1,935.00 an ounce.

US stocks rose for a third day in a row as investors analyzed economic data that hinted at a slight slowdown in growth, leading some to dismiss the hawkish stance the Federal Reserve reiterated in its June meeting minutes as outdated. Accordingly, the S&P 500 ended the session 0.4 percent higher after swinging between gains and losses as investors digested a flurry of data. The Nasdaq 100 index of technology stocks, whose members were more sensitive to rising bond yields, also rose. The two-year and 10-year US Treasury yield curve remained inverted. The dollar maintained its gains. Oil fell below $100 a barrel, extending its decline for a second day.

All eyes were on the Fed when it revealed the details of its June meeting on Wednesday afternoon. The minutes showed that Federal Reserve officials agreed last month that interest rates may need to continue to rise for longer to prevent rising inflation from taking hold, even if it slows the US economy. But on Wednesday, traders also wrestled with economic data that indicated a slight slowdown in the pace of growth, leading some to conclude that the Federal Reserve's meeting minutes do not reflect the current reality of the economy.

Gold Forecast

The general bearish trend for the gold price is getting stronger and the recent market losses pushed the technical indicators towards oversold levels, and I expect gold investors to take advantage of the recent declines to think about buying gold again. The most appropriate buying levels are currently 1725, 1700 and 1685 dollars, respectively. On the other hand, there will be no chance for the bulls to control the trend again without the stability of the gold price above the psychological resistance of 1800 dollars again.

The gold market will be affected today by the level of the US dollar and the extent of investors' appetite for risk, as well as interaction with global geopolitical tensions.