Gold prices were not able to stop the strength of the US dollar, which it described recently as temporary. The price of XAU/USD gold fell to the level of 1688 dollars an ounce in early trading today, Thursday, after gains at the beginning of the week’s trading, reaching the level of 1724 dollars an ounce. The price of gold is now around the level of 1690 dollars an ounce, waiting for any news. Gold tried to hold above the $1700 level and struggled to register any significant momentum. With the rise in interest rates and the strength of the US dollar, the yellow metal has failed to make any gains that would give renewed bullish strength. The question now is: Can prices stay in the $1,700 range?

The price of gold fell by more than 1% over the past week, which increased its decline since the start of the year 2022 to date by more than 6.5%. Silver, the sister commodity of gold, has been making a boost since it touched $18. However, the price of the white metal is still 2% lower over the past week and about 20% over the course of 2022.

Is More Weakness on the Horizon?

Market analysts note that the 1.3% decline in the US Dollar Index (DXY), a measure of the US currency against a basket of other major currencies, has prevented investors from selling gold. The DXY dollar index is currently trading around 106.5, below its peak of 109.29. But it's up 11% since the start of the year. A strong profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

Commenting on the performance of the gold market. “The significant drop in the US dollar index this week is limiting selling interest in precious metals,” said Jim Wyckoff, chief analyst at Kitco.com. “However, the rise in US Treasury yields this week and the volatile crude oil market are crushing the bulls.”

The US Treasury market was mostly higher across the board, with the benchmark 10-year bond yield again above 3%. But market experts are watching the spread between 2-year and 10-year returns, which flipped and faced 20 basis points. The rise rate environment is usually bearish for metals because it raises the opportunity cost of holding non-yielding bullion.

Moreover, the Fed's hawkish decision and the possibility of a 100bps rate hike at the Federal Open Market Committee (FOMC) policy meeting next week weighed on the metals market. Meanwhile, with more global central banks adopting a boost, including the European Central Bank (ECB), industry watchers believe this will erode some of the dollar's exceptional gains this year and support gold prices.

Relative to the prices of other metals, copper futures rose to $3.358 a pound. Platinum futures rose to $870.60 an ounce. Palladium futures rose to $1,891.00 an ounce.

Stock Markets and Gold Trading

US stocks rose yesterday in a volatile session as investors analyzed the latest corporate news and the potential for geopolitical risks in Europe. The dollar rose, while the euro fell as the Italian government looked on the verge of collapse. By performance, the S&P 500 index posted its first gain in nearly two weeks, with advances in technology stocks and consumer discretionary stocks offsetting declines in defense, utilities, and healthcare. While tech stocks briefly trimmed their advances after Google said it would pause hiring for two weeks, Netflix Inc. Earnings better than feared spikes in their streaming peers in addition to confidence in the resilience of consumers.

In extended trading, shares of Tesla Inc. After the electric car maker reported profits that beat Wall Street estimates, reflecting progress in getting production back on track. Alcoa Corp also posted better-than-expected earnings.

Today's XAU/USD Gold Price Forecast:

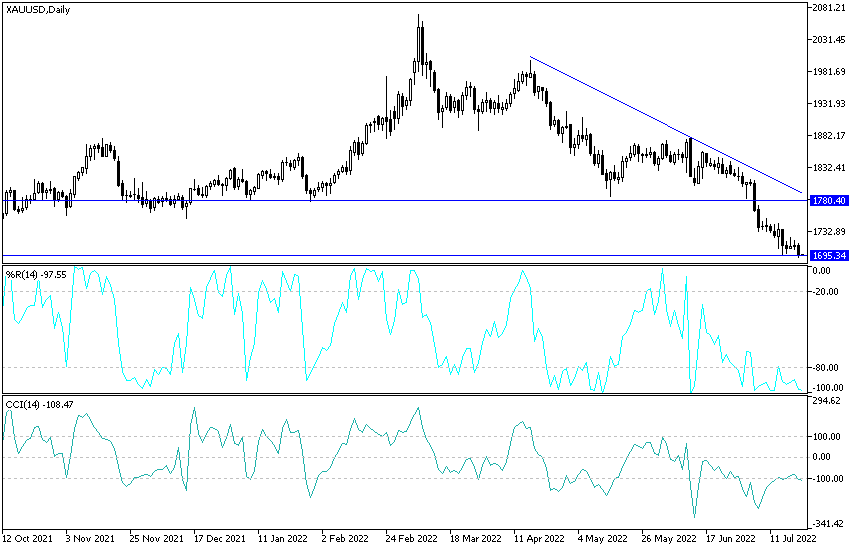

The downward trend of the XAU/USD gold price is getting stronger by abandoning the psychological support level of 1700 dollars. As mentioned in the recent technical analyses the trend may strengthen to the downside if prices move towards the support levels of 1685 and 1660 dollars, respectively, which is at the same time an opportunity to think about buying gold again. These levels are sufficient to push technical indicators towards oversold levels. On the other hand, according to the performance on the daily chart, a first reversal of the trend will not occur without the gold price moving towards the resistance levels of 1755 and 1770 dollars, respectively.