At the end of last week's trading, the price of gold settled above the level of $1700 an ounce, and its gains extended to $1,740 an ounce, before closing the week's trading stable around the $1,726 level. Gold's gains were driven by the weakness of the US dollar and growing fears of an economic recession. Accordingly, the price of the yellow metal is preparing for weekly gains, but it is still in the red throughout the year. With global central banks raising interest rates, investors have turned to a bearish trend in gold prices.

Overall, XAU/USD gold prices are on track to achieve a weekly increase of around 1.5%, but are down more than 5% YTD 2022. The price of silver, which is the sister commodity of gold, is also enjoying upward momentum. Silver futures rose to $18.805 an ounce. Accordingly, the price of the white metal recorded a tepid weekly jump of 0.8%. However, it is down about 20% since the start of 2022.

In general, precious metals mostly benefit from a weak dollar.

Where is the Dollar index heading in regards to Gold?

In this regard, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 106.32, from opening at 106.59. The DXY Dollar Index will post a weekly decline of 1.6%, but is close to 11% YTD 2022. The lower amount is beneficial for dollar-priced goods because it makes them cheaper to buy for foreign investors.

The price of gold has also risen due to lower Treasury yields, which reduce the opportunity cost of holding non-yielding bullion. The benchmark 10-year yield fell 11.2 basis points to 2.796%. The one-year note slipped 6.5 basis points to 3.028%, while the 30-year note yield fell 7.6 basis points to 2.998%. But markets are paying attention to inverted two- and ten-year returns. The spread is close to -20 basis points, the deepest in more than two decades. The links have also been upside down for about two weeks. Investors are watching the yield curve inversion because it has served as a reliable recession indicator since 1955.

On the economic data front, the S&P Global Manufacturing Purchasing Managers' Index (PMI) fell to 52.3 in July. The Services PMI and Composite PMI slipped back into contraction territory, with readings of 47 and 47.5, respectively. Regional surveys also weakened, while initial US jobless claims rose to their highest levels since November 2021.

In other metals markets, copper futures rose to $3.3815 a pound. Platinum copper futures rose to $868.00 an ounce. Palladium futures rose to $2,042.00 an ounce.

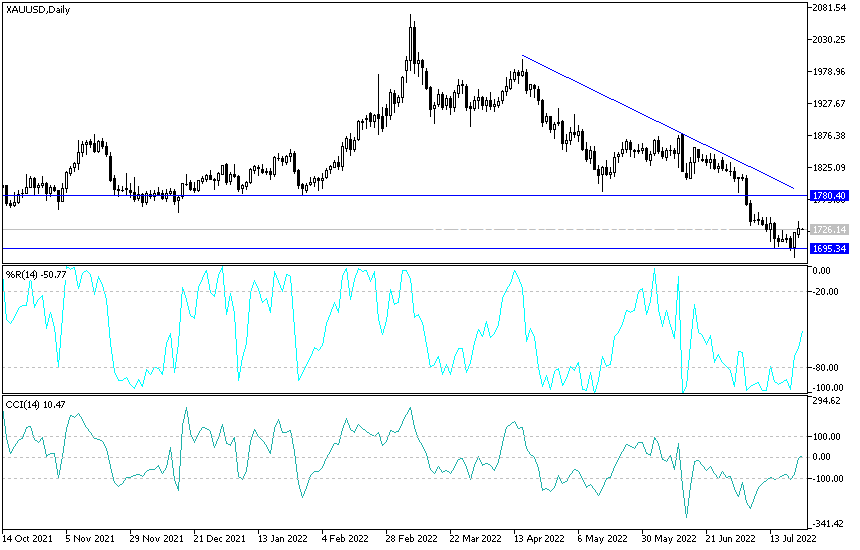

XAU/USD gold price technical analysis:

In the near term and according to the performance on the hourly chart, it appears that the price of the yellow metal XAU/USD is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to extend gains towards $1,733 or higher to $1,739. On the other hand, the bears will look to pounce on short-term gains around $1,720, or lower at $1,713.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a sharp descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current lows towards $1,705 or lower to $1,680 an ounce. On the other hand, the bulls will target the long-term bounces around $1,746 or higher at $1,769 an ounce.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.