Despite the recent bullish rebound attempts, the XAU/USD gold price remains near an 11-month low as investors assess the strength of the US dollar amid concerns about global economic growth, as well as inflation expectations and interest rate hikes. The XAU/USD gold price rose at the beginning of the week's trading, reaching the level of $1724 an ounce, recovering from the selling that pushed it towards the support level of $1697 an ounce. Amid the strength of the US dollar, expectations of raising US interest rates are higher than previously expected.

Bullion just capped with its fifth consecutive weekly loss, the longest such streak in nearly four years, as investors favor the US currency as a haven asset, and tighter monetary policy weighs on the non-interest-bearing precious metal.

Federal Reserve officials are on track to raise US interest rates by 75 basis points for the second month in a row when they meet later in July, after policymakers rejected a larger increase. Investors have reversed bets on a full percentage point move after cautious comments from officials including Atlanta Fed President Rafael Bostic and James Bullard of St. Louis, along with lower long-term inflation expectations for US consumers easing some fears that pressure Prices have become entrenched.

Friday's economic data also showed that US retail sales were stronger than expected in June, underlining the economy's resilience despite monetary tightening.

Bond traders and investment banks speculated that the Federal Reserve could take a more drastic move to raise US interest rates by 100 basis points at its July 26-27 meeting, after economic data showed consumer prices rose 9.1% for the year through June, a new 40-year high. general. But policymakers dismissed that possibility, saying a 75 basis point hike would still be a big step and cautioned about the risks of large-scale increases.

And on his part. The US central bank is now trying to catch up by raising interest rates and shrinking its balance sheet. Officials raised 75 basis points last month, the largest increase since 1994, and indicated they were likely to do the same again when they meet next week.

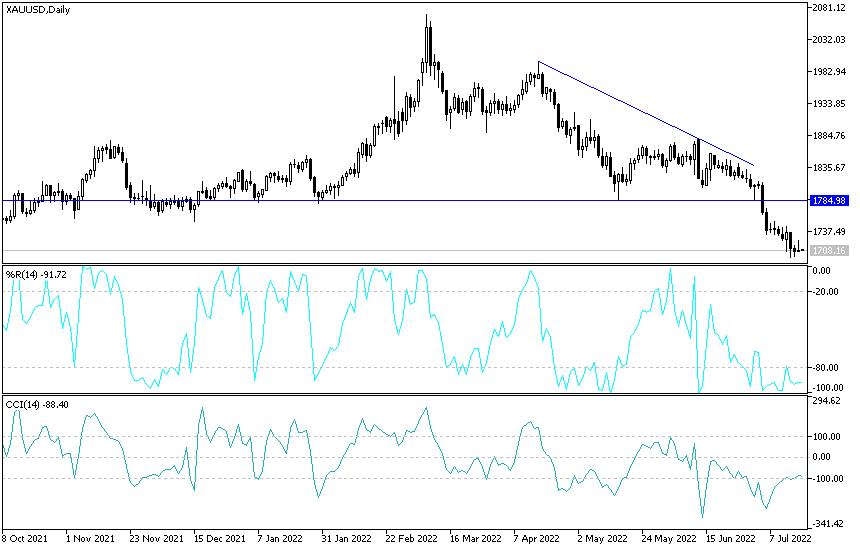

So far, the general trend of XAU/USD gold price is still bearish and stability around and below the $1700 support level still supports the bears' control of the trend. Despite the recent weak attempts to bounce back, I still prefer buying gold from every bearish level. The gold market is receiving momentum from the continuation and increasing global geopolitical tensions led by the Russian / Ukrainian war and the recent political anxiety in Britain and Italy, in addition to renewed fears of an epidemic.

The closest support levels for gold are currently 1685 and 1660 dollars, respectively. A reversal of the bearish outlook for the XAU/USD gold price will occur if the prices move towards the resistance levels of 1745 and 1775 dollars, respectively.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.