For two days in a row, gold prices are trying to rebound upwards, but the gold market did not find strong momentum. The price of Gold in USD terms did not exceed the $1724 level, and with the lack of momentum, the gold price settled around the $1710 level at the time of writing. But the upside was only slight as investors opted to buy stocks amid improving risk sentiment hoping the Fed will be less aggressive with its policy at its next meeting later this month.

The weak dollar supported the yellow metal. The US dollar index fell for the third day in a row, hitting its lowest level in one week in the European session, in response to comments by several Federal Reserve officials that the US central bank is likely to stick with its decision to raise interest rates by 75 basis points this month.

Data from the Commerce Department showed that US housing starts fell 2% to an annual rate of 1.559 million in June after declining 11.9% to a revised rate of 1.591 million in May. The continued decline came as a surprise to economists, who had expected housing starts to jump 2.3% to an annual rate of 1.585 million from 1.549 million originally announced for the previous month. With the unexpected decline, initial housing starts slumped to its lowest annual rate since it hit 1.505 million in April of 2021. The report showed that building permits also fell 0.6% to an annual rate of 1.685 million in June after falling 7% to an annual rate of 1.685 million in June. 1.695 million in May.

Building permits, an indicator of future housing demand, are expected to decline 2.7% to an annual rate of 1.650 million.

US stocks extended gains as investors evaluated earnings expectations amid speculation that disappointments may already be priced in the markets. By performance, the S&P 500 Index rose, jumping more than 1.5 percent as all eleven industrial groups rose. The broad rise in the Nasdaq 100 tech stock index, up more than 2 percent, was reversed, as shares of giant Apple Inc. rebounded. and Alphabet Inc. From Monday's losses ahead of Netflix Inc.'s earnings. Due later today. Johnson & Johnson posted gains even though it lowered its profit and revenue forecast for the year.

With the potential for earnings disappointments in the markets, any upside surprises could lead to big gains. Investors remain on high alert for signs that high inflation and monetary tightening are putting pressure on consumers and employment, and allocation to stocks has fallen to levels last seen in October 2008, according to Bank of America's latest monthly fund managers survey.

Meanwhile, the euro rose to its highest level in nearly two weeks after Bloomberg News reported that the European Central Bank may consider raising interest rates on Thursday by double a quarter of a previously set point to counter deteriorating inflation. Markets are pricing in about 38 basis points of tightening on Thursday, as the European Central Bank is expected to raise interest rates for the first time in more than a decade. This reflects a 50/50 probability of a 50 basis point increase. Overall, a significant price hike would bring the ECB more in line with its global peers who are raising their policy rates very quickly.

The European Central Bank is under pressure to tame inflation, but the prospect of a Russian gas halt could push Europe into recession. The European Union is preparing to tell members to cut gas consumption "immediately" to preserve supplies for the winter, according to a report.

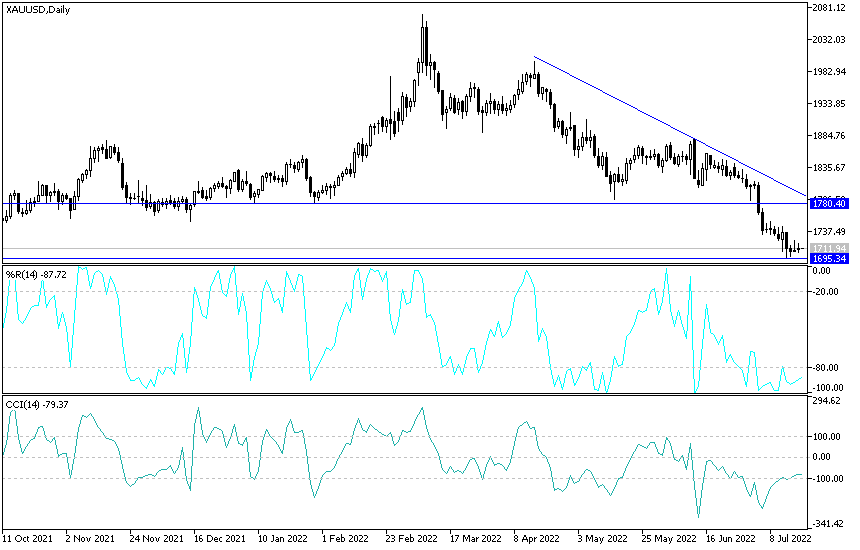

Gold Forecast

The general trend of the gold price is still bearish, and stability around and below the support level of 1700 supports this. With the weak rebound upwards, the bears may move in prices to stronger buying levels, and I think that they are the best ones to buy at 1685 and 1660. I still prefer buying gold from every bearish level. Global geopolitical tensions are on the rise and it is a fertile environment for gold as a safe haven.

The general trend of gold will not turn to the upside without breaching the $1750 and 1775 resistance levels, respectively.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.