Prior to the closing of last week’s trading, the price of the USD/JPY currency pair was exposed to profit-taking operations that pushed it towards the 135.56 support level on Friday. This was the lowest for the currency pair in more than two weeks. It settled around the 136.15 level at the beginning of this week’s trading. The US dollar gave up some of its recent record gains against the rest of the other major currencies, as some statements by the Federal Reserve's monetary policy officials calmed the path of markets' expectations about the rates and times of US interest rate hikes, especially with US inflation continuing to record records.

What will Interest Rate Announcement Lead To?

This week, the US dollar pairs will be watched with the announcement of a new US interest rate hike by the Federal Reserve and the US economic growth rate figure. Some Fed officials suggested last week that US inflation figures for June did not move them in favor of raising US interest rates at a faster pace, forcing markets to rethink bets on an emerging risk of a full percentage point. increase this month.

It also comes after potentially relevant comments from Federal Reserve Chair Jerome Powell during a panel discussion at the European Central Bank's annual conference on central banks last month, which indicated a degree of indifference to the anti-inflationary tailwinds that the strong dollar has triggered over the past year or more.

As per the fundamental analysis, USD/JPY is trading influenced by the Bank of Japan's decision to keep the benchmark interest rate unchanged at -0.1% in line with expectations. The Asian country also recorded a 2.4% (year-on-year) increase in its national consumer price index for June, compared to the previous month's 1.5% increase. Core non-food, energy and fresh food CPI increased by 1% and 2.2% (included) respectively versus 0.8% and 2.1% in the previous period.

From the US, the S&P Global Manufacturing PMI for July beat market expectations at 52 with a reading of 52.3. On the other hand, both the composite PMI and the services PMI missed expectations. Prior to that, initial US jobless claims came in below 240 thousand with a record of 251 thousand, while continuing claims did not exceed 1.34 million with 1.384 million. On the other hand, the Philadelphia Fed Manufacturing Survey for July came in at -12, missing expectations at a reading of 0.

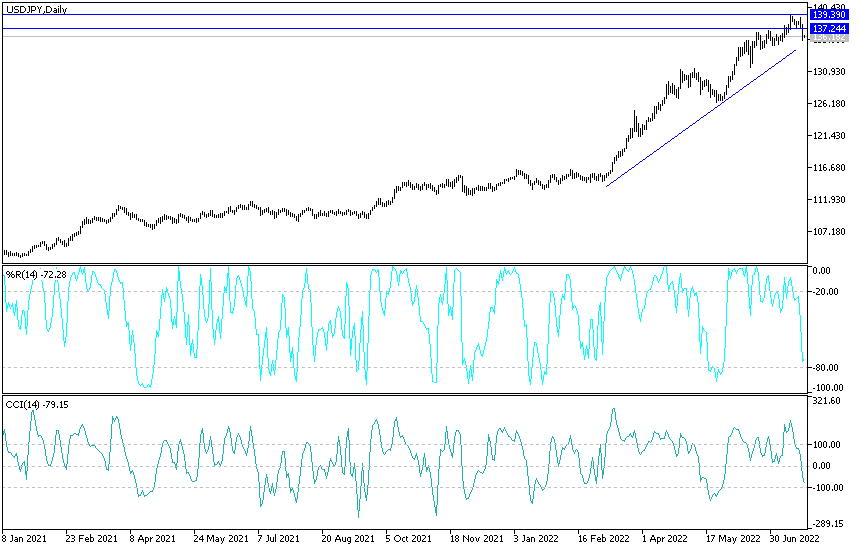

USD/JPY Technical Analysis:

In the near term and according to the performance of the hourly chart, it appears that the USD/JPY is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to ride the current downtrend by targeting profits at around 135,562 or lower at the 135.109 support. On the other hand, the bulls will target the short-term bounces around 136,494 or higher at 136,921.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY has declined recently to complete the downside breach of forming an ascending channel. This indicates that the bears are trying to control the pair away from the bulls. Therefore, they will look to extend the current decline towards 134.41 or lower to the 132.12 support. On the other hand, the bulls will target long-term profits at around 1.37.42 or higher at the 139.32 resistance.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.