My previous signal on 10th August was not triggered as there was no bearish price action when the price first reached the resistance levels which I had identified.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered before 5pm Tokyo time Tuesday.

Short Trade Idea

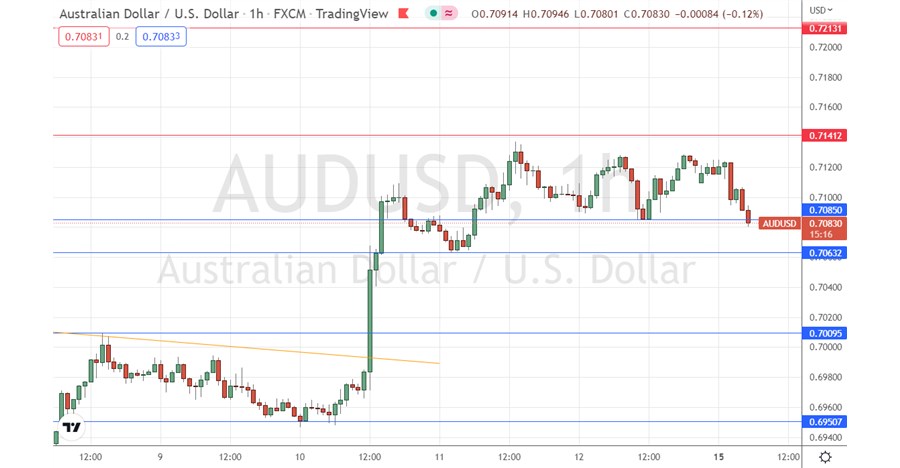

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7141.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7063, 0.7010, or 0.6951.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous forecast on 10th August that the AUD/USD currency pair was moving within a new bearish price channel. I saw the upper trend line as quite confluent with a key resistance level which itself was confluent with a major round number at 0.7000.

I saw a short trade as the most likely set-up from 0.7000, but I was completely wrong: the lower than expected US inflation data sent risk sentiment soaring and the price of this currency pair rising strongly enough to easily break out of the bearish price channel and well beyond it.

We saw the price of this currency pair continue to rise for a while on the improved risk appetite, with the Australian Dollar acting as a barometer of risk sentiment. However, the resistance level at 0.7141 has been too strong for the price to exceed, and it has produced a bearish consolidation. We now see the price start to break down below the former support level at 0.7085 and begin to threaten the next support level at 0.7063.

If the price can make two consecutive lower hourly closes below 0.7063, that could be a good short trade entry signal, as the price would then have a lot of room to fall before reaching a support level – the next level is not until 0.7010.

There is quite a lot of activity in this currency pair right now, so it is not a bad time to be trading it. However, bear in mind that as today is a Monday, price movement might be a bit limited.

I would not take any long trades here today except from a bullish bounce at 0.7010 – if such a movement also rejected the round number at 0.7000, that would be even better.

Regarding the AUD, the Reserve Bank of Australia will release its Monetary Policy Meeting Minutes at 2:30am London time. There is nothing of high importance scheduled today concerning the USD.

Regarding the AUD, the Reserve Bank of Australia will release its Monetary Policy Meeting Minutes at 2:30am London time. There is nothing of high importance scheduled today concerning the USD.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.