The Dow Jones Industrial Average rose during its recent trading at the intraday levels, to achieve gains for the third consecutive day, by 0.97%, to gain about 315.50 points. It settled at the end of trading at the level of 32,845.14, after the index rose in trading on Thursday by 1.03%, During the past week, the index rose by 3%, while the index advanced during the trading month of July by 6.7%, which is the best monthly performance in July since 2010.

The positive mood in equities is partly due to weaker-than-expected US GDP figures on Thursday, which led to more expectations of a reduced pace of Fed rate hikes, especially after Fed Chairman Jerome Powell said the next increase would be dependent on data.

Personal consumption spending rose 1.1% last month after rising 0.3% in May, the Bureau of Economic Analysis reported. The consensus by economists was for a 0.9% increase, and personal income rose 0.6% in June.

Annual PCE inflation jumped to 6.8% in June from 6.3% the previous month, topping the 6.7% rise analysts had expected. Growth in the core index, the Fed's preferred measure, accelerated to 4.8% from 4.7%, against Wall Street expectations of 4.7%.

Consumer sentiment rebounded in July from a record low the previous month as inflation expectations eased, according to data from the University of Michigan consumer surveys released on Friday.

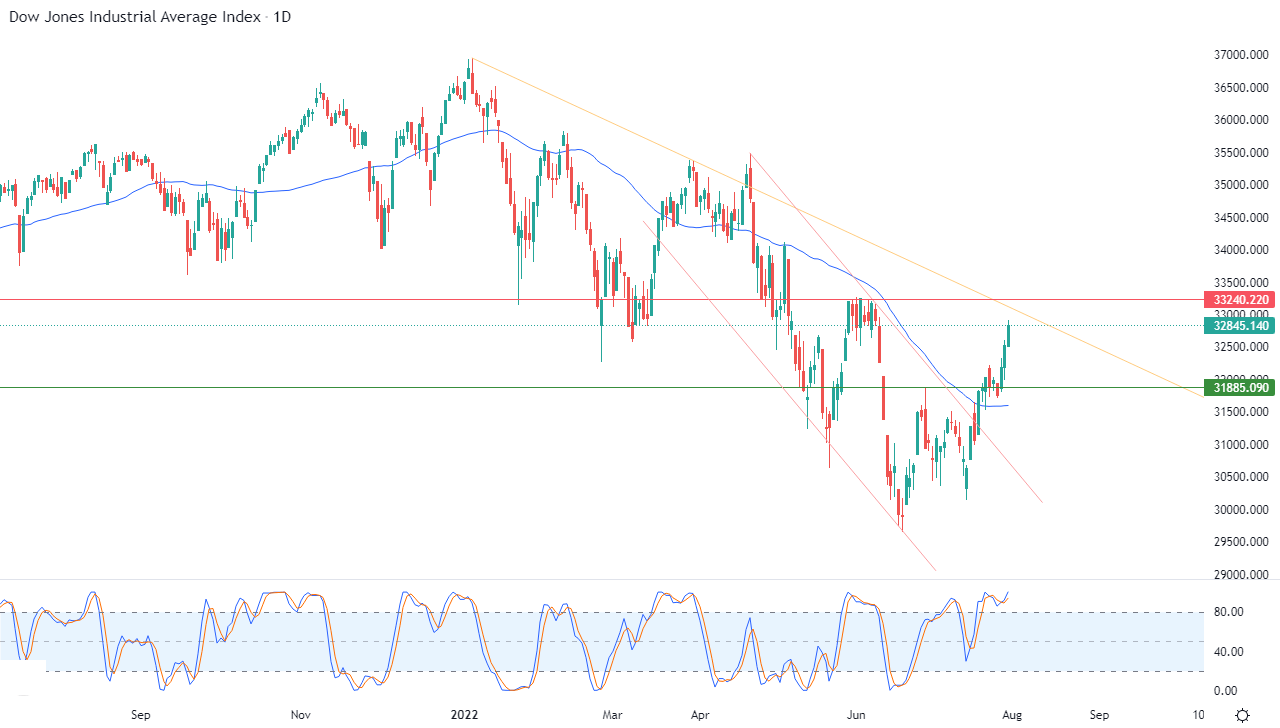

Dow Jones Technical Forecast

Technically, the index continues to rise in line with a bearish corrective slope that aligns with its previous movements in the short term. This is shown in the attached chart for a period of time (daily), supported by its continuous trading above its simple moving average for the previous 50 days. This is in addition to the influx of positive signals on the relative strength indicators, despite its stability in areas that are highly saturated with purchases.

Therefore, our expectations continue for a more cautious rise for the index during its upcoming trading, throughout the stability of the support level 31,885, to target the pivotal and close resistance level 33,240, as testing this resistance coincides with the index facing the corrective bearish trend line.

Ready to trade the Dow Jones 30? We’ve shortlisted the best CFD brokers in the industry for you.

Ready to trade the Dow Jones 30? We’ve shortlisted the best CFD brokers in the industry for you.