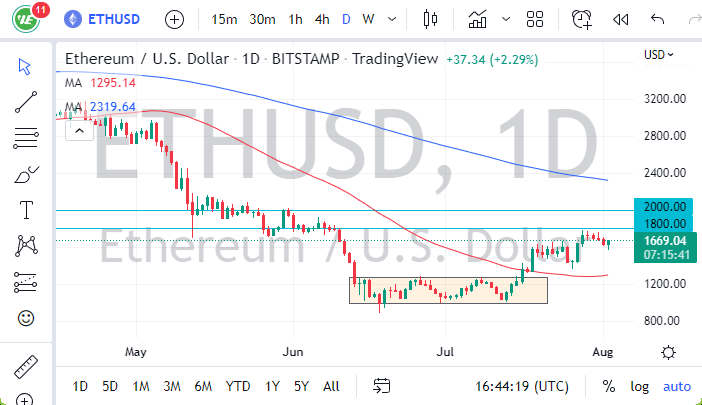

- Ethereum markets initially dipped on Tuesday but then turned around to show signs of life.

- At that point, the market then turned around to break above the $1650 level.

- The $1800 level is a significant barrier just above that could come into the picture, perhaps adding a bit of a short-term ceiling.

- It’s worth noting that the area has a significant amount of resistance extending all the way to the $2000 level. The $2000 level with a large, round, psychologically significant figure, and the scene of a lot of noise in the past.

On the other hand, if we break down from here, it’s likely that we would see this market struggle and drop down to the 50-day EMA. The 50-day EMA is sitting just above the $1200 level, so it could suggest a bit of a floor. However, it’s also worth noting that the market has been noisy to say the least, and I think that a turnaround at this point in time would make sense as I think we are more likely than not to go back and forth in a consolidation area. If we were to break down below the $1200 level, then it’s possible that we drop down to the $900 level.

Breaking down below the $900 level opens up a massive selling opportunity, perhaps sending Ethereum down to the $500 region. That’s an area where I think the longer-term believers would start to build up a bit of a position. In this general vicinity, one would have to think it becomes more of a “buy-and-hold” type of situation. At that point, we would probably look at this as a long-term accumulation phase waiting to happen, giving us an opportunity to make massive profits over the long term. However, that doesn’t mean that the market has to move on your timeframe. In other words, it may continue to go sideways much longer than you are comfortable with, so you have to think of this through the prism of investment down at that level.

I think the only thing that you can probably count on at this point in time is going to be a lot of choppy and sideways action, and I just don’t see how that changes any time soon. After all, there are a lot of concerns out there around the world when it comes to the economy.

Ready to trade our ETH/USD forecast? We’ve made a list of the best Forex crypto brokers worth trading with.