The EUR/USD reached its lowest levels in the long term last week and will face a battle to hold above a level close to technical support around 0.9911 on the charts in the coming days. This is until the mood lights up in global markets or the burden represented by the European Union in lightening the spread.

The single European currency bucked the trend in other places when it rebounded against the dollar during the opening session of the new week's trading. The EUR/USD gains extended to the resistance level of 1.0055 only, and it settled around the 1.0010 level at the time of writing the analysis. The Euro was not able to sustain an initial recovery above par and may need a marked improvement in investors' risk appetite to avoid fresh losses in the coming days.

The sharp bearish performance comes after Federal Reserve Chairman Jerome Powell spooked financial markets on Friday, leading to losses for risky assets, by warning that US interest rates are likely to rise to a "restricted level" and stay there "for some time" until in the event of an economic downturn in the United States.

Commenting on the performance, Carol Kong, Economist and Forex Analyst at the Commonwealth Bank of Australia said, “EUR/USD has recovered some of the losses caused by Powell and is trading near parity. Standard European natural gas futures fell by about 20% after Germany said its gas stores were filling up faster than planned, providing some relief to the euro. and companies. For her part, European Commission President Ursula von der Leyen said that the European Union is looking to intervene to break the link between gas and electricity prices. Details of the EU's intervention plan have yet to be announced.

Overall, runaway natural gas prices have weighed heavily on the Euro and other regional currencies in recent months but provided relief to many by pulling back from record highs in August on Monday while the single European currency may have also benefited from ECB policy developments. Some members of the European Central Bank's board of directors also used the symposium in Jackson Hole to convince markets of their efforts to combat inflation. As Isabelle Schnabel, a member of the European Central Bank's Executive Board, pointed out, as did Powell, there was no choice but to stick to the normalization path to control inflation even if the eurozone slipped into recession.

The European Central Bank's monetary policy outlook will return to focus early this week with the release of German and broader European inflation numbers for August on Tuesday and Wednesday. This could affect market expectations of the size of the interest rate move next week. However, EURUSD remains sensitive to changes in European gas prices and is also likely to respond this week to US economic data including Thursday's release from the Institute of Supply Management (ISM) manufacturing PMI and US non-farm payrolls data on Friday.

EUR/USD forecast today:

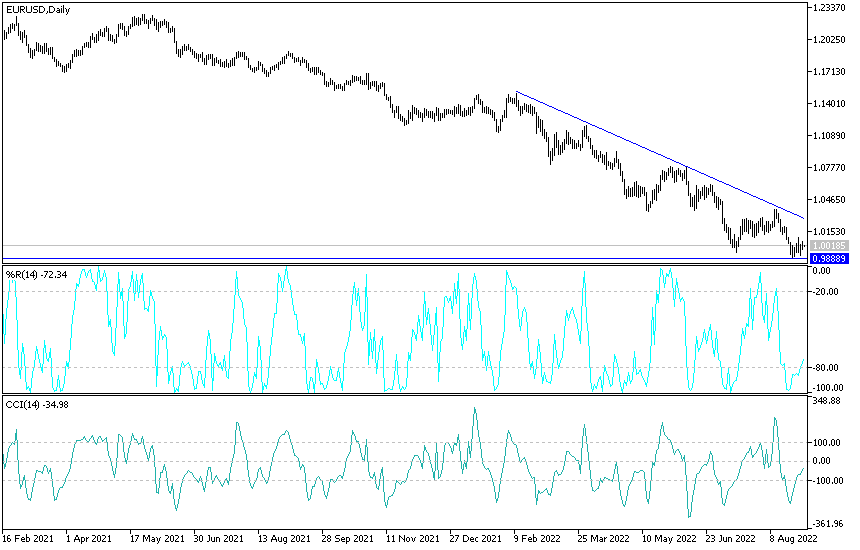

- There is no change in my technical view of the performance of the EUR/USD currency pair.

- The general trend is still bearish.

- Stability below the parity price supports the bears for further movement down and the losses stopped recently from the European Central Bank’s signals about the future of tightening.

This weakens the euro's efforts to recover. The closest attempts to rebound upwards are currently 1.0075, 1.0120 and 1.0200, and the last resistance to break it supports an initial change of direction.

I still prefer to sell Euro dollars from every bullish level until the energy crisis in Europe is finally resolved. On the other hand, the bears are ready to move towards the support levels 0.9945 and 0.9870, respectively, if the US jobs data comes in stronger than expected.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.