- The price of gold fell for a second day after Federal Reserve Chairman Jerome Powell backed away against hopes that the US central bank would begin easing monetary policy soon.

- The chairman indicated instead that US interest rates will continue to rise and remain elevated to stamp out inflation.

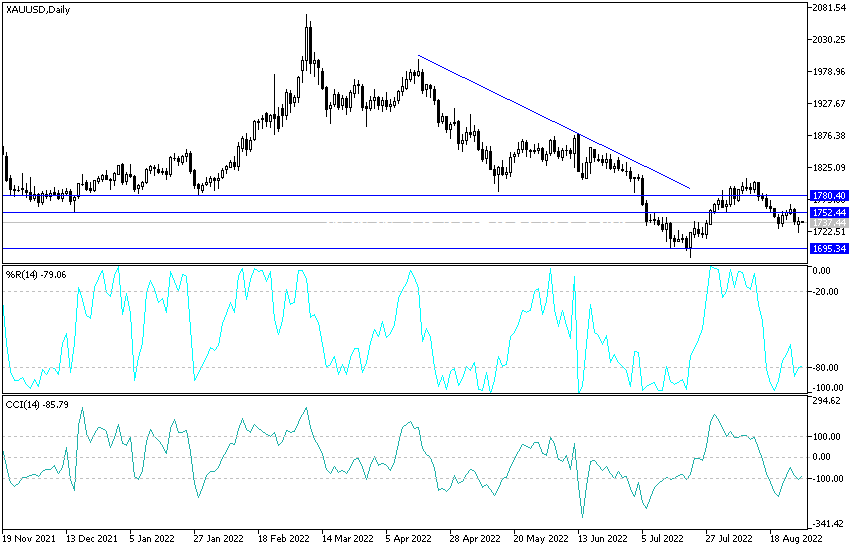

- Accordingly, the gold price (XAU/USD) fell to the $1720 support level for an ounce, its lowest in a month, before settling around $1737 an ounce at the time of writing the analysis.

Gold prices are headed for a fifth monthly decline, the longest stretch in four years. This happened after the Federal Reserve raised interest rates, weakening the allure of the non-interest-bearing metal. The strong dollar also affected gold, which is priced in the US currency. The two-year Treasury yield has reached its highest level since 2007.

"Restoring price stability is likely to require maintaining a restrained political position for some time," Said the US Federal Reserve Governor Powell Friday, in remarks at the Federal Reserve's annual policy forum in Jackson Hole, "Historical record warns severely from the policy of premature mitigation,” he added.

He reiterated that another "unusually large" increase in the benchmark lending rate may be appropriate when officials meet next month. However, he did not commit to one, saying the decision will depend on "the totality of incoming data and changing expectations."

Commenting on the market performance, John Finney, director of business development at Sydney-based bullion dealer Guardian Gold Australia, said that "This has to be the most hawkish rhetoric from the Fed chair at some time."

“Although gold is under pressure from the strength of the US dollar at the moment, if we see an increase in volatility in the US stock market, we can expect gold to receive a safe-haven bid,” he added.

Meanwhile, Senator Elizabeth Warren took aim at the Federal Reserve's anti-inflation game plan on Sunday, saying she was concerned the central bank could push the US economy into recession. The senator remarked that she did not believe an interest rate hike could contain current price pressures.

The DXY US dollar index rose to its highest level in 20 years, making gold priced in US dollars expensive for those holding other currencies.

Matt Simpson, chief market analyst at City Index, said gold's momentum has shifted to the downside, and while there will be a safe haven influx at some point, investors are currently focused on keeping interest rates high.

Echoing the Fed's position, ECB Governing Council member Isabel Schnabel said central banks must act aggressively to combat inflation, even if it drags their economies into recession. While gold is often considered a safe haven during financial uncertainties, it is highly sensitive to rising US interest rates, which increase the opportunity cost of holding non-yielding bullion while strengthening the dollar.

Gold Forecast:

According to gold experts. Gold is likely to head towards $1,700 and has room to go to $1,680. You can get some buyers stepping in around $1,680 to support the market and back to $1,750 again. Data from the US Commodity Futures Trading Commission showed that speculators reduced their net long positions in Comex gold by 15,910 contracts to 30,326 in the week

Today’s Gold Price Analysis:

The continued strength of the US dollar impedes any efforts and attempts for the gold price to recover. Therefore, it is expected that the downward pressure for the gold price will continue until the announcement of US job numbers, the main driver of the markets. Stronger readings would support the dollar and negatively affect gold and vice versa. Until then, it may test new buying levels, the strongest of which are currently 1716 dollars and 1675 dollars, respectively. Whatever the buying opportunity, we do not advise taking any risks.

On the upside, there will be no real change to the current trend without the gold price testing the psychological resistance level of $1800 an ounce.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.