Natural gas prices (CFDS ON NATURAL GAS) declined in the recent trading at the intraday levels. By the moment of writing this report, they recorded daily losses of -0.37%, settling the price of $9.092 per million British thermal units. Prices decreased by - 2.07% during yesterday’s trading.

US natural gas futures fell more than 3% on Tuesday, tracking lower European rates, with prices hitting a two-week low as US inventories rose.

On its first day, front month NG1 gas futures fell. October delivery went down by 29.4 cents, or 3.1%, to settle at $9.042 per million British thermal units, after falling to its lowest level since August 16 earlier in the session.

Gas production in the lower 48 US states rose to 98.1 billion cubic feet per day on Monday, the data provider Refinitiv said, the highest level since Aug. 8.

Wholesale gas prices fell in Britain and the Netherlands, as Europe nearly reached its goal of having gas stocks 80% full.

Europe was also preparing for a scheduled disruption of the Nord Stream 1 pipeline, which runs under the Baltic Sea to Germany, for three days from August 31 to September 2. Because of this, market players worried that flows may not resume.

Meanwhile, a restart delay at the fire-hit Freeport Liquefied Natural Gas (LNG) export plant in Texas is leaving more fuel in the US for utilities to refill storage.

Technical Outlook

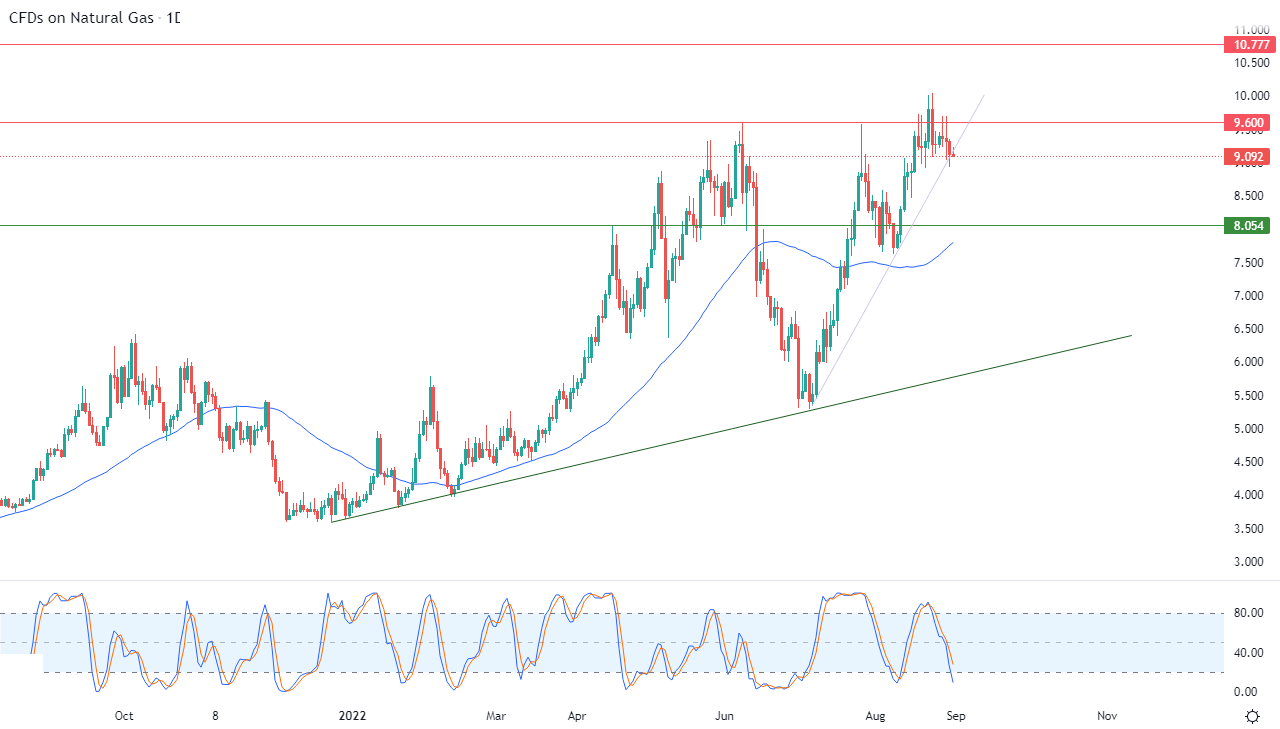

- Technically, the decline of natural gas comes because of the stability of the pivotal resistance level 9.600, amid the influx of negative signals on the relative strength indicators.

- This is despite reaching oversold areas, so that the price is trying to gain positive momentum that may help it recover and breach that resistance, considering the control of the main bullish trend.

- On the medium and short term, along a slope line, as shown in the attached chart for a (daily) period, with the continuation of the positive support for its trading above its simple moving average for the previous 50 days.

Therefore, our expectations indicate the possibility of the scenario of a return to the rise of natural gas during its upcoming trading. It is expected to target again the pivotal resistance level 9.600 in preparation for attacking it.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.