Spot natural gas prices continued to rise in recent trading at intraday levels, to achieve new daily gains until the moment of writing this report, by 0.68%. It settled at the price of $9.460 per million British thermal units, after rising sharply during yesterday’s trading. By 5.91%.

Natural gas futures ended yesterday's session at their highest levels since 2008, buoyed by supply shortages in the US and Europe, as European gas prices remained elevated after the weekend amid maintenance activity in Norway, while flows through the Nord Stream 1 pipeline remain significantly restricted. big.

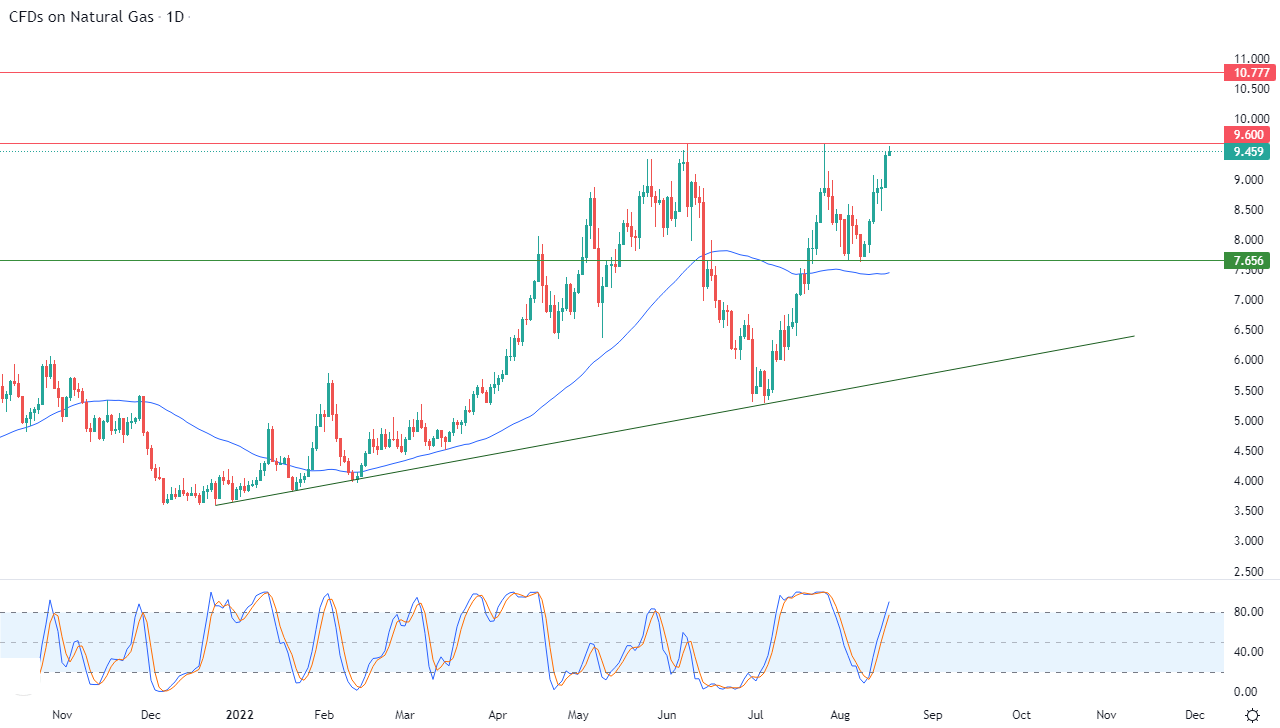

Natural Gas Prices

Prices in the US also remain high amid rising temperatures, and although the temperatures are cooling down, hurricane season is still lurking.

Analysts expect the US Energy Information Administration on Thursday to report an increase of 34 billion cubic feet in US gas inventories for the week ending August 12, according to a survey by S&P Global Commodity Insights, which indicated that a rise in that volume would be much lower. of an average five-year storage of 47 billion cubic feet.

So far this year the price of gas in the first month has risen by about 150%, as higher prices in Europe and Asia maintain strong demand for US LNG exports. Global gas prices have risen this year after supply disruptions linked to Russia's invasion of Ukraine on February 24.

Technical Outlook for Natural Gas

Technically, natural gas is now preparing to attack the pivotal resistance level 9.600, amid the dominance of the main bullish trend in the medium and short term along a slope line. This is shown in the attached chart for a (daily) period, with the continued influx of positive signals on the relative strength indicators, despite reaching areas. The price is very saturated with buying operations, and the price is also benefiting from the continuation of the positive pressure to trade above its simple moving average for the previous 50 days.

Therefore, our expectations indicate that natural gas will continue to rise during its upcoming trading, but on the condition that it first breach the obstacle of the resistance level 9.600, and then target the resistance level of 10.70.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.