As the performance by the end of last week's trading, the USD/JPY currency pair completed the downward path, extending its losses towards the 131.60 support level, the lowest in a month and a half. The strength of the Japanese yen has been prominent in the recent period against the rest of the other major currencies led by the dollar. A key measure of inflationary developments in the United States adds to the evidence that peak inflation is approaching, weighing on the dollar at the beginning of August.

According to official figures, the ISM price index fell to 60 in July from 78.5 in June, and the market was looking for a stronger 74.3. This was the lowest reading of the index since August 2020 and indicates the price line has declined. Commenting on this, Andreas Steno-Larsen, Director of Heimstaden says: "This is big news because it tops the CPI by 4 months." And on his part. “Price expansion grew significantly in July, but instability is,” says Timothy R. Fiore, president of the Institute for Supply Management (ISM).

The July manufacturing PMI came in at 52.8%, down 0.2 percentage point from the 53% reading in June but ahead of expectations of 52.0. The ISM price index is a measure of the cost pressures manufacturers face, and given these pressures are usually passed on to consumers, they provide a clue as to where CPI inflation is heading. The data add weight to the arguments that inflationary pressures in the US are nearing a peak, and with it the Fed's rate-raising cycle. While there are more Fed increases ahead, the size and total number of increases will be adjusted downward based on any data indicating that inflationary pressures are beginning to decline.

Given that the Fed's raising cycle has supported the dollar for months now, any change in market expectations could affect the dollar going forward.

The ISM price data helps ensure that the dollar's soft start to August continues. For its part, the Federal Reserve raised US interest rates by another 75 basis points last week and said it will now be more data-dependent than in the past, which amounts to a significant departure from its long-term policy of providing forward-looking policy guidance.

The summary data is more important than it has been in the past, so the focus on the ISM price index aligns with the Fed's latest pivot. However, the Bureau of Economic Analysis said last Friday that its measure of inflation, the core PCE price index, rose 0.6% month over month in June, topping analysts' consensus expectations of 0.5% and doubling May's reading of 0.3%. The index is up 4.8% in the year to June, above the 4.7% the market was looking for and the previous figure of 47%.

PCE is of great importance to Fed policy as “the FOMC inflation target is set in terms of the rate of change in the price index of total personal consumption expenditures (PCE),” according to the Fed. But arguably, ISM manufacturing data tells us where PCEs will go in the coming months as consumer inflation lags producer price inflation.

Any further evidence of slowing inflation over the coming weeks will add to expectations that the current dollar cycle will have peaked.

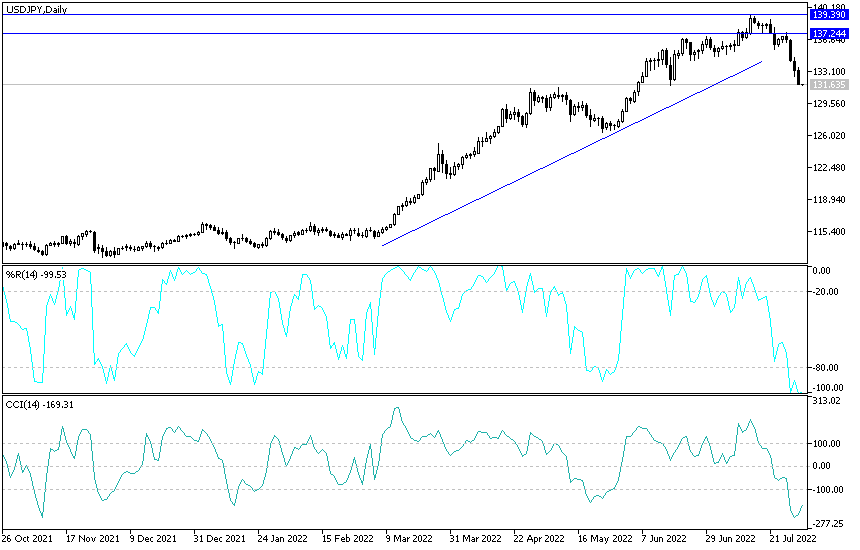

Forecast of the dollar against the yen:

There is no doubt that the recent move of the USD/JPY currency pair succeeded in breaking the general upward trend. The trend will turn according to the performance on the daily chart to a sharp bearish by testing the psychological support level of 130.00 if that happens. We expect the bears’ control to remain in place until the numbers are announced. US jobs at the end of the week are the first driver of the dollar's trend against the rest of the other major currencies. The recent losses have moved all technical indicators towards strong oversold levels, and I expect to think of buying from closer and more appropriate levels, which are currently 130.90 and 129.80, respectively.

On the other hand, and over the same time period, breaking the resistance 135.00 is important for the bulls to control the trend again.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.