For the second day in a row, the price of the USD/JPY currency pair is trying to recover higher with gains to the resistance level of 133.90 today. This is after strong selling recently that pushed it towards the 130.40 support level, the lowest in two months. We recently witnessed an uprising of the Japanese yen against the other major currencies. The US dollar has fallen since the recent policy update of the US Federal Reserve, in addition to the announcement that the US economy has entered a recession.

Dollar Economic Data

US employers recorded fewer job openings in June as the US economy faces severe inflation and rising interest rates. US job vacancies fell to 10.7 million in June from 11.3 million in May, the Labor Department said. Jobs, which did not exceed 8 million in the previous month last year, exceeded 11 million per month from December through May before declining in June.

The number of Americans who left their jobs fell slightly but remained high at 4.2 million in June, while layoffs fell to 1.3 million from 1.4 million in May, the Labor Department said in its monthly survey on job opportunities and employment turnover.

The US labor market has been resilient so far this year, and companies have complained of difficulty filling vacancies: employers added an average of 457,000 jobs per month in 2022; US unemployment is near its lowest level in 50 years. This is one reason why many economists believe that the US economy has not yet gone into a recession even though GDP, the broadest measure of economic output, has shrunk for two consecutive quarters - a baseline for the onset of the downturn.

The Labor Department's July jobs report, released on Friday, is expected to show employers processed another 250,000 jobs last month, a number that would be fine in normal times but the lowest since December 2020, when the global economy was devastated. from the epidemic. Economists also expect US unemployment to remain at 3.6% for the fifth consecutive month, according to a survey by data company FactSet.

The US economy is under pressure as the Federal Reserve raises interest rates to combat inflation, which is running at the fastest pace in four decades.

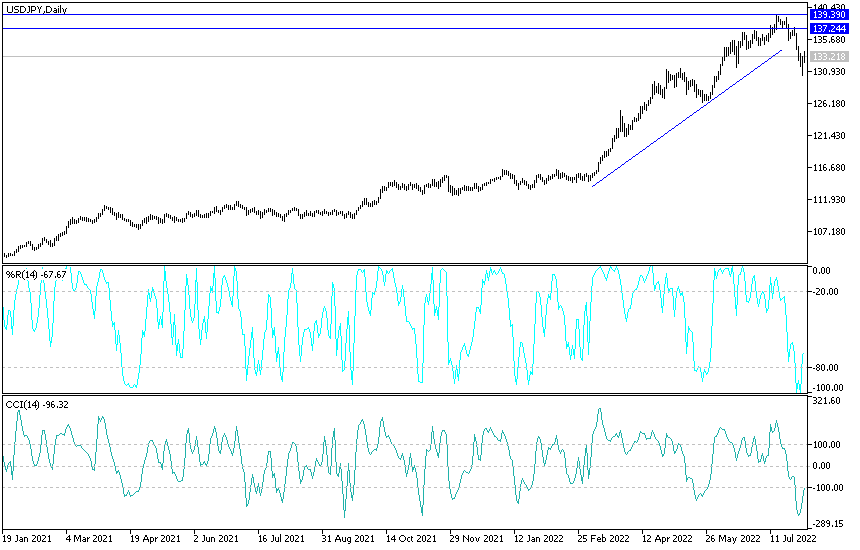

Forecast of the US dollar against the yen:

On the daily chart below, USD/JPY is trying to return to the vicinity of the general bullish trend and that may happen if the bulls move in the currency pair towards the resistance levels 134.60 and 136.00 respectively. On the other hand, and as I mentioned in the recent technical analyses, it will be important to break the psychological support level of 130.00 to turn the general trend into a bearish one. The US dollar will be affected today by the announcement of the ISM Services Purchasing Managers' Index reading.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.