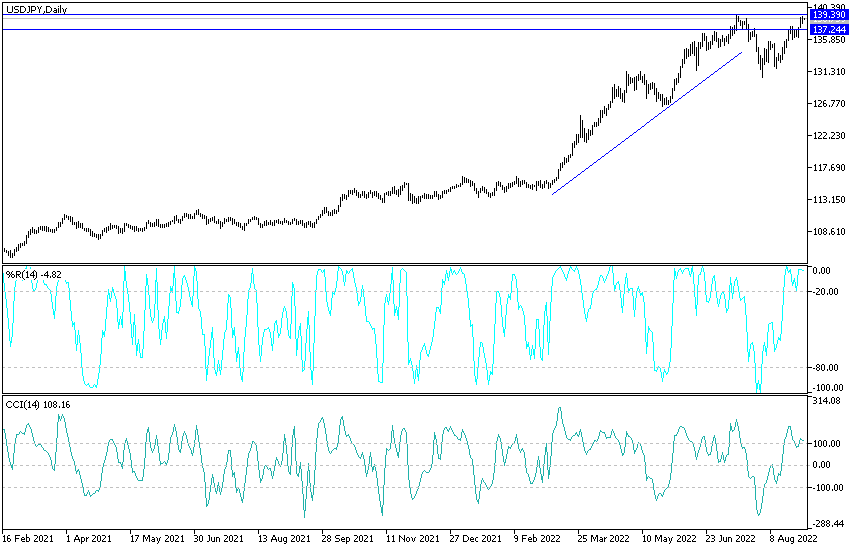

The price of the USD/JPY currency pair is still maintaining its bullish momentum until the US job numbers are announced at the end of the week. This is the most important event for the dollar and the markets for this week. The dollar yen gains reached the resistance level of 139.07, the closest point to the next psychological resistance 140, and it is settling around the level of 138.50 at the time of writing the analysis. The results of the economic data and the indications of the Fed officials still support more US interest rate hikes and thus more positive momentum for the US dollar.

US monetary policy

Richmond Fed President Thomas Barkin vowed that the US central bank would not relent in its efforts to cool rates, but warned that it may not be a smooth process. "We are committed to bringing inflation back to our 2% target and we will do what it takes to make it happen," Barkin said yesterday. And “I expect inflation will bounce back to our target.”

Federal Reserve Chairman Jerome Powell and his colleagues have notified investors of their determination to keep raising US interest rates until inflation subsides. In a speech Friday at the Federal Reserve's annual retreat in Jackson Hole, Wyoming, he declared that lowering price pressures toward their 2% target was their "overall focus" and that they would not blink even though it likely caused pain to American households and businesses. "Obviously stagnation is a risk in the process" of slowing inflation, added Barkin, who did not vote on the policy this year. "It doesn't have to be like the 2008 recession, it doesn't have to be catastrophic."

The Fed's preferred measure of inflation has more than tripled that level at 6.3% in the 12 months through July, near the fastest pace in 40 years. Monetary policy is acting with delays, Barkin said, "so I don't expect inflation to drop immediately."

For its part, the Federal Reserve raised US interest rates by 75 basis points in its last two meetings, and Powell said that another unusually large increase of this size could be on the table when they meet from September 20 to 21, with the decision between that or half a point is smaller. Based on "total" data received since it was collected in late July. Barkin also said there are two risks to the US economy if the Fed fails to act: Demand will remain too high, and the public will lose faith in the Fed's anti-inflation credibility. "The Fed's responsibility is to work to reduce inflation," he added.

The highlight of this week is Friday's US employment report, but before that, the ISM survey will be closely scrutinized after last week's S&P global purchasing managers' indexes suggested that both the manufacturing and services sectors continued to fall deeper into recessions. Much of the market's focus will be on what each of the above numbers indicate about the potential size of the Fed's September rate move, a decision widely seen as an omission between a 0.75% increase and a smaller 0.5% move.

For his part, Federal Reserve Chairman Jerome Powell acknowledged on Friday that the size and pace of interest rate steps will eventually continue to slow even as the US economy heads towards a period during which borrowing costs are likely to remain at their peak for longer than financial markets give.

Forecast of the dollar against the Japanese yen:

- The general trend of the USD/JPY currency pair is still bullish.

- The opportunity to move towards the 140.00 psychological resistance is possible, and even more so if the US jobs numbers this week come in stronger than all expectations.

- This will indicate that the Fed is working well and that the Fed raise Interest did not lead to a recession in the US economy as previously thought.

On the other hand, according to the performance on the daily chart, the pair's direction may change initially if it moves towards the support levels 136.20 and 134.60, respectively.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.