For three trading sessions in a row, the bulls are moving at the price of the USD/JPY currency pair to the upside until the US jobs numbers are announced tomorrow, Friday. This will be the strongest driver of the US dollar pairs for this week's trading. The rebound gains for the dollar-yen pair brought it to the level of 134.55 before settling around the level of 133.85 at the time of writing the analysis. The rebound came from the support level 130.40, which confirmed the break of the bullish trend.

Expectations of a US interest rate hike continue to support record gains for the US dollar in the currency market. In this regard, James Bullard, President of the Federal Reserve Bank of St. Louis, said he favored a strategy of raising interest rates “from the front,” and reiterated that he wanted to end the year at 3.75% to 4% to tackle the hottest inflation in four decades. "We still have some ways to go here to get to tight monetary policy," Bullard added in an interview with CNBC. "I've argued now that with the hotter inflation numbers in the spring, we should get to 3.75% to 4% this year." Deciding whether you want to do this at a particular meeting, or another is a great question. I loved the front loading. I think it enhances our anti-inflation qualifications.”

All in all, Fed chairs, including Pollard's speech this week, emphasized that US inflation at a 40-year high has not yet slowed, and pushed against the perception that the US central bank was heading towards a less aggressive phase of monetary tightening. Last week, Federal Reserve Chairman Jerome Powell cited the FOMC's forecast that the Fed will raise US interest rates to 3.4% at the end of the year and 3.8% in 2023.

"We're going to have to see compelling evidence via the headline and other measures of core inflation that all come down convincingly before we're able to feel like we're doing enough," Bullard added. He later added that the Fed may have to keep interest rates "higher for a longer period" to see a broad-based slowdown in price growth.

Financial markets are pricing rate cuts as soon as the first half of 2023, and some investors took Powell's comments at last week's press conference as a sign that the Fed could soon become less aggressive. Overall, the Federal Reserve raised US interest rates by 75 basis points for the second consecutive meeting, and Powell said that another increase of this size would be possible in September. He did not provide specific guidance for the future and said that future price increases will be data-driven and will be determined in one meeting after another.

Bullard also said he agreed with Powell's view that the United States is not in a recession, noting that strong job growth is more convincing than the negative two quarters of GDP seen by some as a sign of slackening. Bullard said he expects growth in the second half of the year. "We're not in a recession right now," he added, and "with all the job growth in the first half of the year, it's hard to say there was a recession."

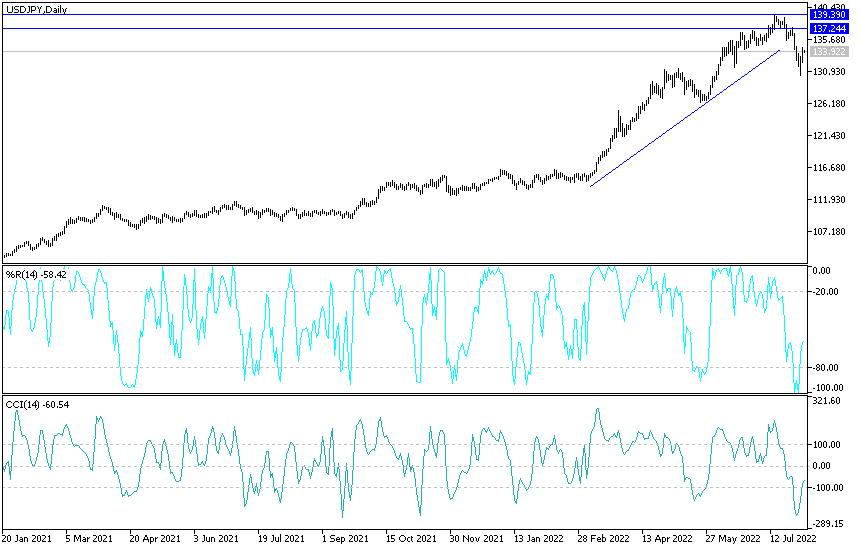

Forecast of the dollar against the Japanese yen:

Before the announcement of the number of US jobless claims and US trade balance figures. On the daily chart below, the USD/JPY price is trying to return to the vicinity of the general bullish trend. This may happen if the bulls move in the currency pair towards the resistance levels 134.60 and 136.00, respectively. On the other hand, and as I mentioned in the recent technical analyses, it will be important to break the psychological support level of 130.00 to turn the general trend into a bearish one.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.