Today's recommendation on the lira against the dollar

Risk 0.50%.

None of yesterday's buy or sell transactions were activated

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

- Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

Turkish lira analysis

According to Vid data, Turkey's total revenues in July were about 196.98 billion Turkish liras, while expenditures were about 260.999 billion liras, bringing the total deficit in July to 64 billion liras. During 2022, the revenues of the general budget in the country were recorded at about 1.642 trillion pounds, compared to the expenditures of 1.432 trillion pounds, as the general budget surplus recorded about 29.5 billion pounds. The lira was not significantly affected, as it quietly traded near its lowest levels during 2022. It is an image that reflects the extent of the Turkish Central Bank's control over setting a ceiling for the lira price.

Technical Outlook for Turkish Lira

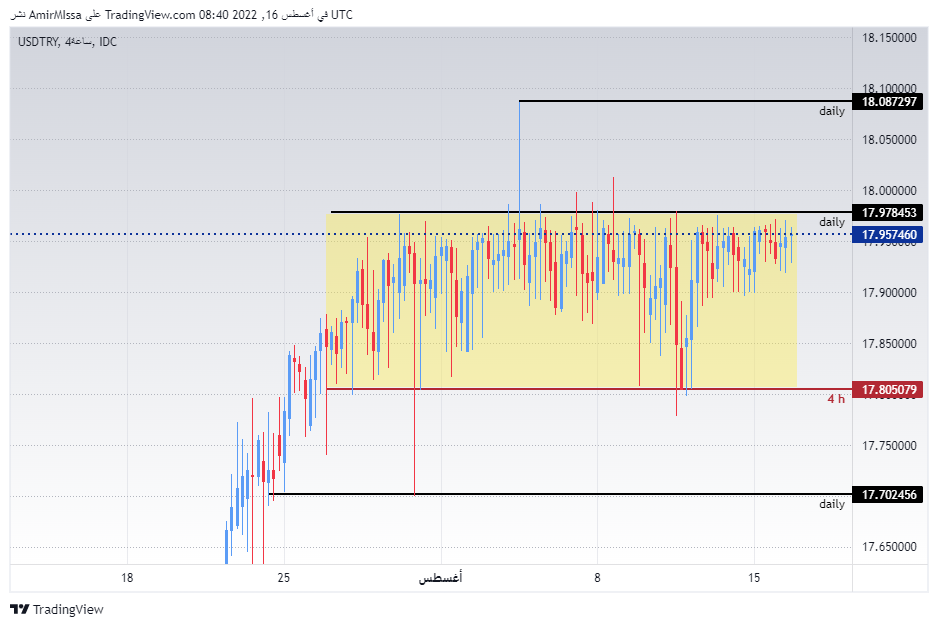

The USD/TRY currency pair settled within the same narrow trading range shown on the chart. The pair traded the highest support levels, which are concentrated at 17.85 and 17.75 levels, respectively. The lira is trading below the resistance levels at 18.00 and 18.07, respectively. The pair is also trading above the 50, 100 and 200 moving averages, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. As each decline of the pair represents a good buying opportunity, please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.