Today's recommendation on the USD/TRY

- Risk 0.50%.

- None of yesterday's buy or sell deals were activated

The best selling entry points

- Entering a sell deal with a pending order from the 18.33 levels

- Place the stop loss point and close the lowest support levels 18.55.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 55 points and leave the rest of the contracts until the strong resistance levels at 17.70.

Best buy entry points

- Entering a buy deal with a pending order from the 17.98 levels

- The best points for placing a stop loss close at 17.74 levels.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 55 points and leave the rest of the contracts until the support levels 18.31

Analysis of the Turkish Lira

The price of the Turkish lira stabilized against the US dollar during early trading this morning, as the lira continues to trade within a narrow trading range amidst interventions by the Turkish Central Bank to control its price.

This is clearly seen during last weekend's trading, where the lira was barely affected by the rise of the dollar against most of the major and emerging currencies, after Federal Reserve Chairman Jerome Powell's statements about sticking to the policy of monetary tightening until reaching the FED’s inflation target.

On the other hand, the Turkish Central Bank has stuck to a stimulus policy after lowering the interest rate by 100 basis points during the current month. In the meantime, reports revealed a government crackdown on independent institutions that aim to track the real inflation rate in the country, which reflects the decline in transparency in government economic data, as many analysts believe that it is unreal figures and manipulated. It is mentioned that the inflation rate in the country is at its highest level in 25 years.

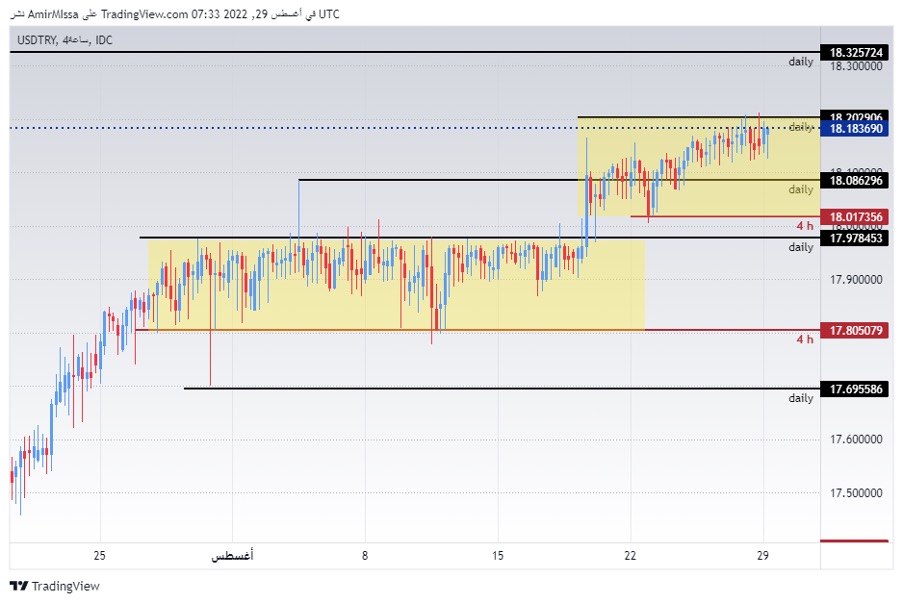

On the technical level, the USD/TRY settled at its highest levels during 2022, after the pair broke through the 18.10 levels, where the pair traded at the top of the narrow trading range, which is illustrated by the chart. The pair is also trading above the 50, 100 and 200 moving averages respectively on the four-hour time frame as well as on the 60-minute time frame, indicating a long-term upward trend. The pair also traded above the support levels which are concentrated at the levels of 18.08 and 17.98 respectively. While the pair is trading below the resistance levels at 18.20 and 18.33, which are above the pair's levels recorded at the end of last year respectively.

The chance of the lira rising against the dollar is still weak as the pair is moving in a generally upward direction. Since every decline for the pair represents a good opportunity to buy please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.