Today's recommendation on the lira against the dollar

Risk 0.50%.

None of the buy or sell transactions of yesterday were activated

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

- Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

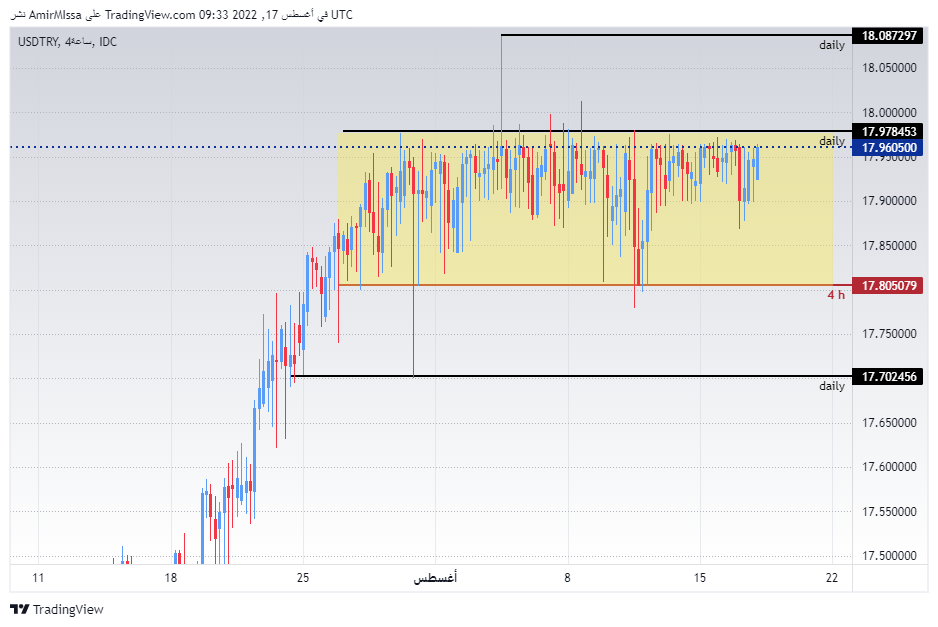

USD/TRY Technical Analysis

The lira stabilized without changes in the price of the USD/TRY currency pair as the pair is trading within a very narrow range. This is amid the absence of influential data from inside Turkey during the day, as well as the clear interference by the Central Bank of Turkey to control the price of the dollar against the lira. Investors followed reports on the Russian-Turkish consensus on the adoption of the local currency in the trade exchange between the two countries. The two sides agreed to pay part of Turkey's natural gas imports in Russian rubles, which may contradict a series of Western sanctions against Moscow. In the same context, a report from the American Newsweek magazine stated that the percentage of Turkish real estate sales to Russian citizens increased during the current year, so that the Russians topped the purchases of real estate in Turkey before the Iranians and Iraqis. It is noting the lack of significant economic impact, especially amid the country's suffering of inflation levels that have not been recorded for nearly 25 years.

The economic situation is not expected to improve significantly in light of the Turkish Central Bank's adherence to a stimulus policy in exchange for monetary tightening in the United States, which raises the value of the dollar.

Turkish Lira Technical Analysis

The US dollar against the Turkish lira settled within the same narrow trading range shown on the chart. The pair traded the highest levels of support, which are concentrated at the levels of 17.85 and 17.75, respectively. While the lira is trading below the resistance levels at 18.00 and 18.07, respectively. The pair is also trading above the 50, 100 and 200 moving averages, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. As each decline of the pair represents a good buying opportunity, please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.