Today's recommendation on the USD/TRY

- Risk 0.50%.

- None of yesterday's buy or sell transactions were activated

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best buy entry points

- Entering a long position with a pending order from the 17.98 level

- The best points for setting stop-loss are closing the highest levels of 17.74.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

USD/TRY Analysis

The Turkish lira's trading has stabilized against the US dollar, after minor declines yesterday, when the pair recorded new levels of rise before resuming the decline and stability within a limited trading range.

Investors followed the statements of Turkish President Recep Tayyip Erdogan, in which he tried to reassure local markets. After significant declines in the price of the local currency, inflation rose after an accommodative monetary policy. The Turkish president said that his country will be embarrassed with minimal losses from the economic turmoil that the world is going through at the present time. He also stressed that Turkey is making its economic model away from easy money and based on production and job creation.

The Turkish president also set the beginning of next year as a date for the current economic decisions to be reflected on the lives of citizens in the country. He also concluded his speech by describing that the current century will become the century of Turkey, as he described it. Despite the enthusiastic statements of the Turkish president, the real situation shows strong control from the Turkish Central Bank to prevent the fall of the lira's price, as the bank intervenes directly or indirectly to control it.

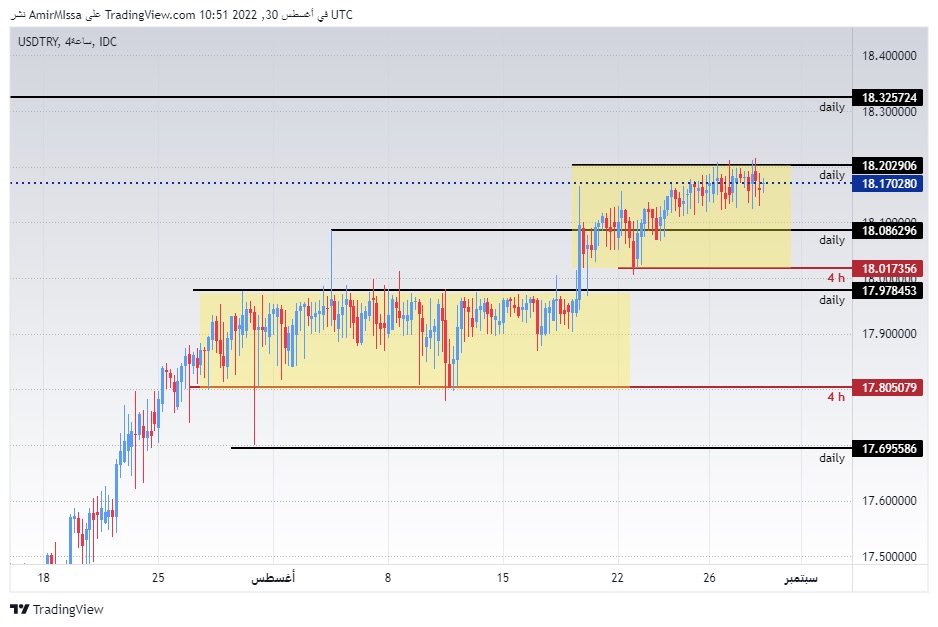

On the technical front, unchanged, the US dollar pair settled against the Turkish lira at its highest levels during 2022. The the pair breached the 18.20 level, trading at the top of the narrow trading range shown on the chart.

The USD/TRY is also trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The pair also traded the highest support levels, which are concentrated at 18.08 and 17.98, respectively. It is trading below the resistance levels at 18.20 and 18.33 as well, which are the highest levels of the pair recorded at the end of last year, respectively.

The chance of the lira rising against the dollar is still slim as the USD/TRY is heading in an overall bullish trend. As each decline of the pair represents a good buying opportunity, please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.