EUR/USD

The Euro has been pummeled during the week, as it looks like we are going to put a serious threat on the parity level. If we break down below the parity level, then the market is likely to go much lower, perhaps down to the 0.98 level. A short-term rally is possible, but I think the 1.03 level will offer a significant amount of resistance. Any rally at this point in time that shows signs of exhaustion will be an opportunity to start shorting and picking up “cheap US dollars.”

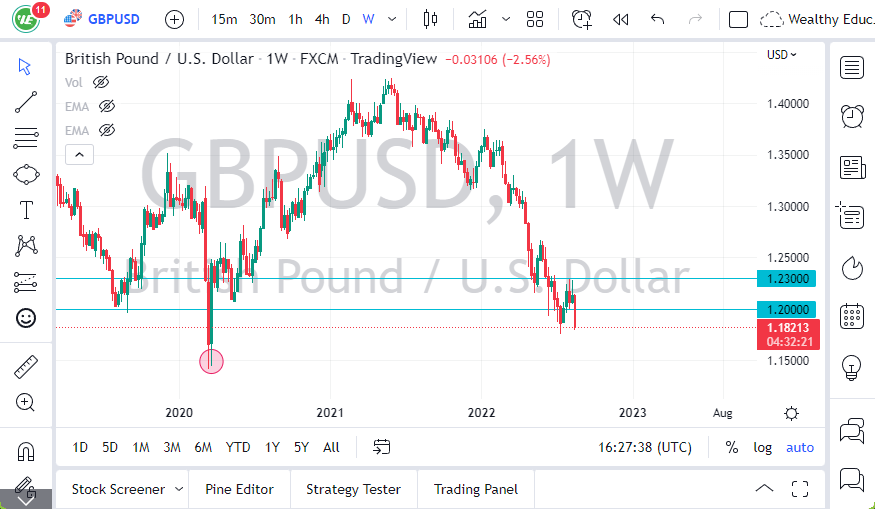

GBP/USD

The British pound has broken down significantly during the week, as we continue to see the US dollar act like a wrecking ball against almost everything. Any rally at this point in time will continue to see a lot of selling pressure, so I think that much like the Euro, I think you are likely to see people willing to pick up “cheap US dollars” on any rally. It’s obvious that people are starting to worry about the central bankers next week spoke in the market as they will continue to talk about massive amounts of interest rate hikes. On the downside, the market could go all the way down to the 1.15 level.

USD/CAD

The US dollar has rallied a bit during the course of the week, to test the 1.30 level. The 200 Week EMA sits just below, just as the 50 Week EMA is starting to turn toward it. At this point, it’s likely that we will continue to see little bits and pieces of support, but this is a market that continues to see a lot of noisy behavior, as we are trying to grind higher based upon the overall uptrend as defined by the channel that we have been in.

USD/JPY

The US dollar has rallied rather significantly during the trading week, to break above the 1.37 level at one point. However, we have seen a lot of noise since then, and have pulled back. Nonetheless, we are still very bullish, so I think at this point in time we are going to look at a market that continues to be more or less a “buy on the dip” attitude, with the ¥132 level underneath offering significant support. Ultimately, this is a market that I think will continue to be very noisy, with the bond markets having a major influence.