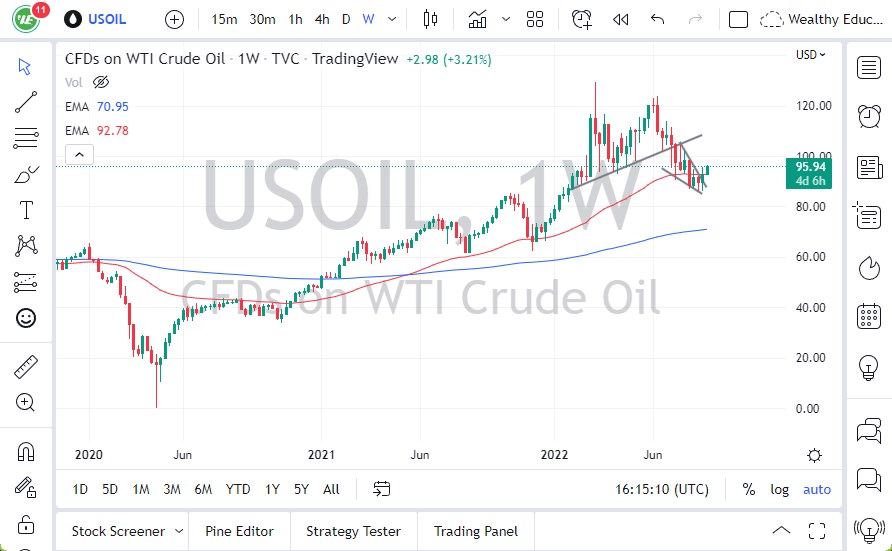

Oil markets have rallied during the last couple of weeks in August, breaking the bank of a “falling wedge. At this point, the market is likely to continue to see a little bit of bullish pressure, and the $100 level is now probably in focus. If the $100 level gets broken to the upside, then it’s likely that we could go higher.

It’s also worth noting that oil markets have a lot of crosscurrents, so I think it’s going to continue to be difficult to trade. This is because OPEC is possibly looking to cut a certain amount of production, as prices have been falling. Furthermore, we have to ask questions about the Russian supply, and whether or not it is going to make it to market.

Pay attention to the US Dollar

At this point though, you also have to pay close attention to the idea of the US dollar coming into the picture, and wrecking profits. After all, this commodity is priced in the very same US dollars, so a stronger US dollar works against it. The market probably continues to be noisy due to not only the OPEC situation but the fact that we also have to worry about the idea of a global slowdown. After all, a global slowdown does suggest that there will be less demand. That obviously could push the price down, especially as the market has the possibility of Iranian oil coming into the picture as well. Regardless, I think the only thing you can count on is chaos, so the most important thing you can do is keep your position size reasonable.

- The $105 level is an area where I would expect to see a significant amount of resistance, so a break above there could open up the possibility of a move to the $120 level.

- If the market was to fall from here, I anticipate that the $85 level would be supported.

- Breaking through that level could bring a lot of selling into the picture.

- In that scenario, we will probably see a major “risk off” type of situation.

I anticipate that September is only going to be more volatile than the last month or 2. We are still in the process of trying to figure out whether we have entered a downtrend or have just had a major pullback. Unfortunately, clarity is something that is not found easily, due to all of the external factors.

Ready to trade our WTI monthly forecast? Here’s a list of some of the best Oil trading platforms to check out.