My previous signal on 6th September was not triggered, as there was no bullish price action when the price first reached rejected the support level which I had identified at 0.6719.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken before 5pm Tokyo time Friday

Short Trade Idea

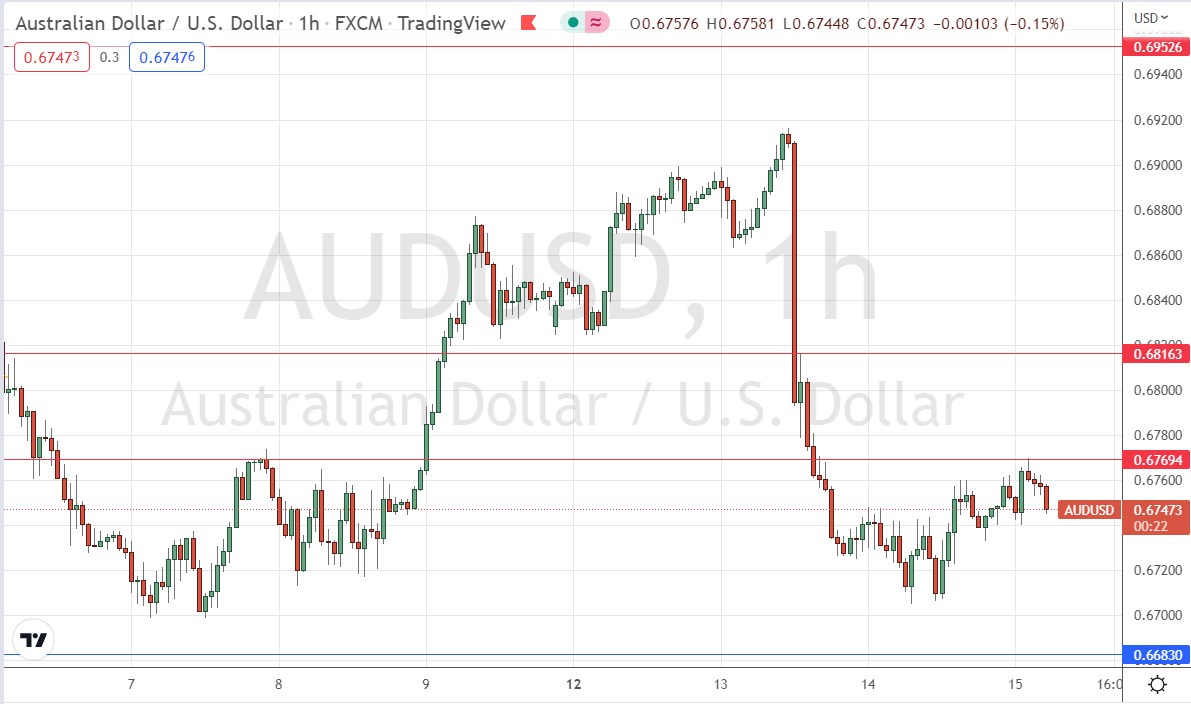

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6769 or 0.6816.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6683.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous forecast on 6th September that the AUD/USD currency pair had only one intersting technical feature: a very strong and pivotal resistance level at 0.6848.

This level was not reached. I also thought that the support level at 0.6719 was likely to be useful for long scalps, but I was wrong about that.

A few days ago we were seeing the Australian Dollar make firm gains against the US Dollar on rallying risk sentiment, but Tuesday’s US CPI data release showed that US inflation is still far from tamed, and is remaining stubbornly high, which increases the likelihood of a full 1% rate hike at the next Fed meeting. This sent the US Dollar higher everywhere and here is no exception. The Australian Dollar is also hit by deteriorating risk sentiment, as a key risk currency.

These factors suggest a bearish approach is going to be best here, and this is partially reinforced by technical analysis as the resistance level nearby at 0.6769 stands out, with the price already falling from there after a recent touch.

Despite the bearish case, it is also true that there has been buying at 0.6700 and below that round number when the price gets down there, so the price has some way to fall, but perhaps not by a lot more.

Even if the price get established above the resistance level at 0.6769, I would still not take a bullish approach, but would also look for a short trade from any bearish reversal at the higher resistance level of 0.6816 following a deeper bullish retracement.

I will not look to take any long trade today, even from the support level at 0.6683.

Regarding the USD, there will be releases of Retail Sales and Empire State Manufacturing Index data at 1:30pm London time. There is nothing of high importance scheduled today concerning the AUD.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.