Bullish view

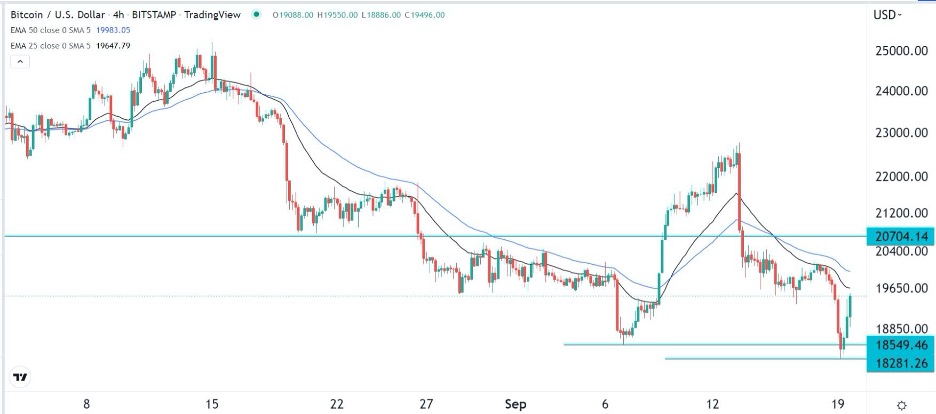

- Buy the BTC/USD pair and set a take-profit at 21,000.

- Add a stop-loss at 18,200.

- Timeline: 1-2 days.

Bearish view

- Set a sell-stop at 18,850 and a take-profit at 17,000.

- Add a stop-loss at 21,000.

The BTC/USD price crashed to a multi-month low of 18,280 as the focus remained on the upcoming Fed interest rates. It also remained under intense pressure as the hype surrounding the Ethereum Merge event faded. The pair was trading at 19,500 on Tuesday morning.

Focus on Federal Reserve

Bitcoin and other risk assets like stocks have been in a steep sell-off recently as investors focus on the soaring bond yields.

The two-year yield, which is a good signal of interest rates rose to a 15-year high of 3.95%. Similarly, the ten and 30-year bond yields rose to the highest level in years. This performance happened as investors waited for the upcoming interest rates.

The Fed will start its two-day meeting on Tuesday and conclude it on Wednesday. Analysts believe that the bank will hike rates by 0.75% for the third time in a row. It will also reiterate its resolve to do whatever it takes to lower inflation, which is still stubbornly high.

Bitcoin and other risk assets tend to underperform in a period of high-interest rates as investors rotate to the relatively high-yielding government bonds. This also explains why American stocks have also crashed in the past few days.

The BTC/USD pair has also struggled lately as the hype surrounding Ethereum Merge faded. Ethereum Merge was seen as the most pivotal events in the cryptocurrency industry. For one, it was the first time that a platform as big as Ethereum changed its architecture from a proof-of-work (PoW) to a proof-of-stake.

Ethereum has led the losses in the past few weeks. It has crashed from over $1,500 to below $1,300. Bitcoin has a close correlation with Ethereum and other cryptocurrencies.

Ready to trade our free Bitcoin trading signals? We’ve made a list of the best Forex crypto brokers worth trading with.