The Dow Jones Industrial Average rose in its recent trading at the intraday levels, to achieve gains for the third consecutive session, by 1.19%. It gained about 377.19 points and settled at the end of trading at the level of 32,151.72, after rising 0.61% in trading on Thursday. The index rose by 2.66%, breaking a series of weekly losses that continued for three consecutive weeks,

Commitment to Fight Inflation

Federal Reserve Chairman Jerome Powell said Thursday that the central bank remains firmly committed to fighting inflation, and that nothing will deter it, whether politically or for any other reason. "I can also assure you that we never take into account foreign policy considerations," Powell said.

The hawkish stance was echoed by several senior Fed officials last week, with Fed Governor Christopher Waller saying on Friday that they may have to raise the benchmark interest rate "above 4%" if inflation does not moderate or rises further this year.

All of this sets the stage for the stock market's next big test, which is inflation data. With the August CPI on Tuesday, results could show a drop to 8.1% from 8.5% in July. If this prediction is correct, this will be the second drop on the market. A row in year-on-year inflation, another pullback may increase the chances that the Fed will slow the pace of rate hikes soon.

Widely expected to raise the key rate by 75 basis points in September, the probability of that volume rise reached 90% on Friday, compared to 57% a week ago.

Dow Jones Technical Outlook

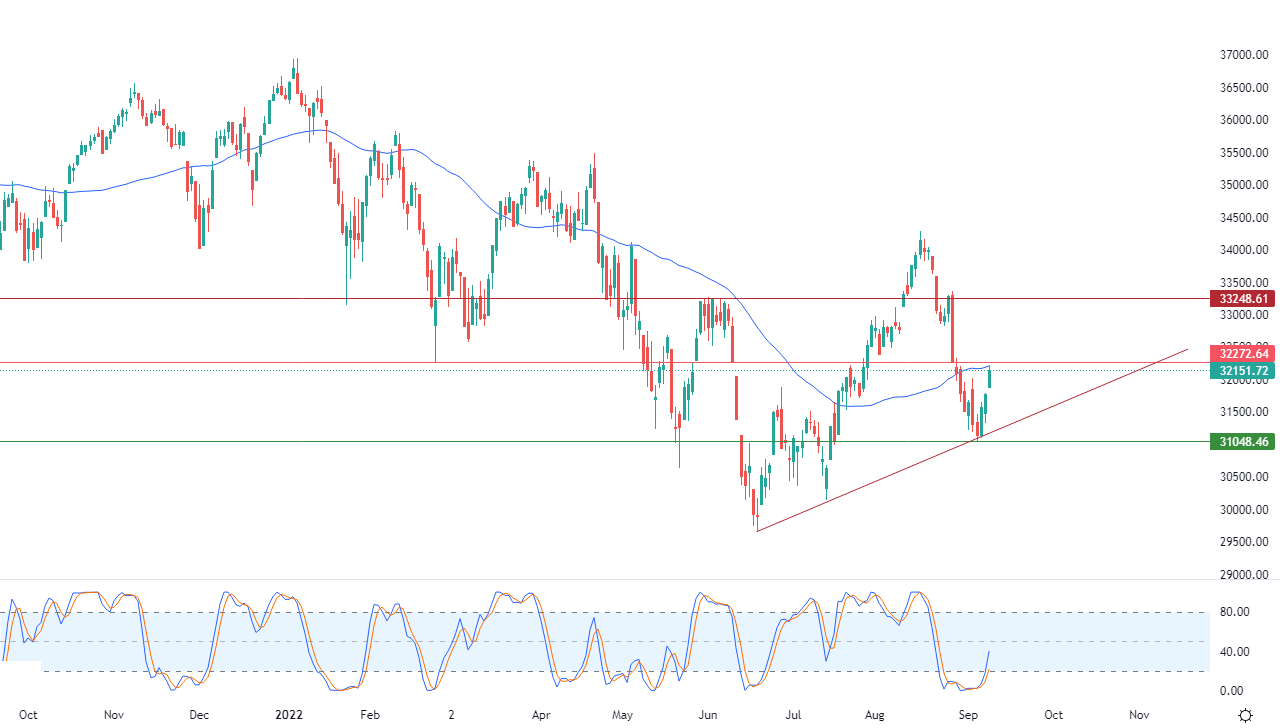

- The index rose in its recent trading along with a corrective bullish trend line in the short term, as shown in the attached chart for a (daily) period.

- It is supported by the influx of positive signals on the relative strength indicators, after reaching earlier areas of oversold sales.

- It finally reached a retest of important resistance level 32,272.65, in conjunction with touching the resistance of its simple moving average for the previous 50 days.

- This adds more strength to that area as a resistance in front of the index achieving more gains.

Therefore, our expectations suggest a return to the index's decline during its upcoming trading, as long as the aforementioned resistance level 32,272.65 remains intact, to target the main support level 31,000.

Ready to trade our US 30 technical analysis? We’ve made a list of the best online CFD trading brokers worth trading with.