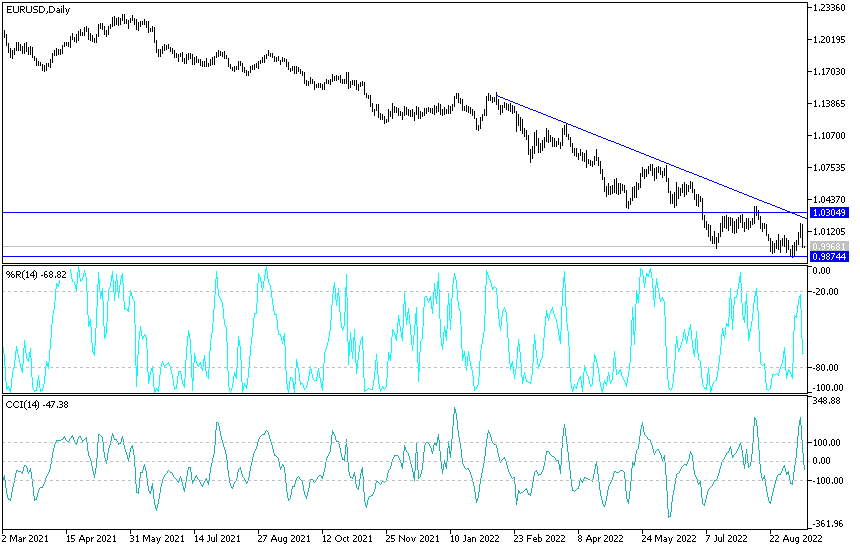

After the announcement of better-than-expected numbers for US inflation, which favors the path of raising US interest rates, the EUR/USD currency pair gave up most of its recent gains. This is following the recent hawkish signals from the European Central Bank. The EUR/USD pair tumbled towards the support level 0.9970 after recent gains that extended to the level Resistance 1.0198 at the beginning of this week's trading.

So far, financial markets support the European Central Bank's determination to raise interest rates further to stem the unprecedented rise in energy prices. Investors are betting that the deposit rate will rise to 2.5% by July for the first time in this excursion cycle, according to trade-offs tied to policy outcome dates. It comes after European Central Bank Governor Christine Lagarde hinted last week that a historic interest rate hike of 75 basis points could be followed by another as part of "several" future moves to escalate officials' offensive against rampant inflation. Core prices in the Eurozone rose for a second month to a record 4.3% y/y in August. Data released on Tuesday showed that US inflation exceeded expectations last month.

Commenting on this, Nihad Shah, Managing Director at Goldman Sachs Group Inc wrote, “Next time, once again, the incoming inflation data is likely to show an acceleration in sequential core inflation, making it very difficult not to raise another 75 basis points while maintaining credibility. “. And “the market should be attracted to a minimum of 175 basis points over the next three meetings with upside risks around 200 basis points.”

These strong bets represent a sharp turnaround from last month when financial markets were more concerned about a possible recession in the region and pricing less than a percentage point of interest rate increases over the next year. That was before focus shifted to the record increase in energy prices and officials raised interest rates by three-quarters of a point last week. The last time borrowing costs exceeded 2.5% was more than a decade ago when the global economy was in the midst of the global financial crisis and officials were rushing to cut interest rates to stave off a recession.

Declines in Gas Supportive

Gas prices are expected to decline during the winter season according to Goldman Sachs, and if correct, the view is expected to ease downward pressure on the EUR. The eurozone's single currency is proving highly responsive to gas prices, as new sub-parity levels against the dollar come amid rising prices. Meanwhile, the euro's recovery over the course of September coincided with a steady decline in gas prices. So further declines in gas prices will be supportive. “We maintain our view that although their prices are at higher levels than we previously expected, the funds will drop sequentially during the winter,” says Samantha Dart, head of natural gas research at Goldman Sachs.

The euro's gains against other currencies, including the British pound, were evident during the month of September amid falling gas prices. “If gas prices do start to drop significantly over the next few months, given that storage facilities appear to be filling up relatively well, especially in Germany, a less profound recession can be expected,” says analyst Marc-Andre Fongern, Managing Director at Fongern Global Forex. Or at most moderately, which will eventually support the euro.”

Before winter arrives, prices should remain high as Europe seeks to attract liquefied natural gas (LNG) cargoes. The need for gas shipments transported by sea to Europe comes amid almost complete closure of the flow of Russian gas to Europe. For its part, Russia's Gazprom announced on September 2 the indefinite closure of the Nordstream 1 pipeline, the vital artery that transports gas from Russia to Germany. But in doing so, Russia played its last card in geopolitical terms: the indefinite shutdown has always been the “worst-case scenario” outcome for the German and European economies in terms of gas supplies.

The fact that the worst has happened now puts an end to the excess speculation in the gas and currency markets.

Forecast of the euro against the dollar today:

- The stability of the EUR/USD currency pair will remain below the parity price, supporting the bears’ control of the trend.

- If the dollar’s momentum factors increase, the currency pair may be exposed to the possibility of moving towards the support levels 0.9930 and 0.9850, respectively, again.

- The currency pair is expected to remain under downward pressure until the release of the rest of the US economic data and inflation figures in the Eurozone.

- On the other hand, according to the performance on the daily chart, breaking the resistance 1.0200 will be important for an initial break of the current bearish trend.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.