In the last three trading sessions of last week, the price of the currency pair EUR/USD settled below the parity price. Its losses reached the 0.9944 support level, the lowest in 20 years, and closed the week’s trading stable around the 1.0012 level. This performance will be watched importantly this week, as the US Federal Reserve will announce a new rate hike in US interest rates, especially after the announcement of US inflation rates rising stronger than expectations.

Rates Need to Control Inflation

The European Central Bank will raise interest rates "several times," according to chief economist Philip Lane. As he told Irish broadcaster RTE in an interview on Saturday. The European Central Bank is still in the process of raising interest rates, and citing its institution's forecast, Lane said a mild recession in the eurozone cannot be ruled out. The European Central Bank this month tightened its policy by a historic 75 basis points, and Bundesbank President Joachim Nagel said earlier that borrowing costs would need to rise much more to control inflation. Nagel says the European Central Bank is still "a long way" from where rates should be.

According to German Central Bank President Joachim Nagel. European Central Bank interest rates will need to rise much more to control inflation, the official added, "We are still very far from interest rates at an appropriate level given the current inflation situation." He added: “More has to happen, rates have to go up – how much is still to be determined.” And “we are still very far” from the neutral rate, the level at which monetary policy neither constrains nor stimulates it.

Speaking at the Bundesbank Open Day in Frankfurt, Nagel - one of the ECB's rate-setting hawks - acknowledged that the economy would slow but said he did not expect a sharp economic slowdown. “I don't see a severe recession,” he said. and "It doesn't look like it's going to be so terrible." While he said annual consumer price growth could peak at 10% in December and a warning that Germany was facing a "hard winter" with double-digit inflation risks, Nagel indicated he was convinced the situation would improve. “I am confident that we will be able to get through the difficult winter behind us and then see inflation rates go down again,” he said.

Nagel also said that the ECB's next actions will be data dependent and highlighted the commitment of policy makers to bring inflation back to the institution's 2% target. "We are fully aware of our responsibilities and will do whatever is necessary to bring inflation down again - I can't promise miracles," he said. And getting there "isn't going to be a sprint, it might be a middle-distance run, and I just hope it's not a marathon."

On the economic side, the EU Harmonized Consumer Price Index (HICP) for August beat expectations (MoM) at 0.5% with a change of 0.6%. The Equation (YoY) matched expectations of 9.1%, while the HICP Ex-Food, Energy, Alcohol and Tobacco Index also came in line with the (MoM) and (YoY) estimates of 0.5% and 4.3%, respectively.

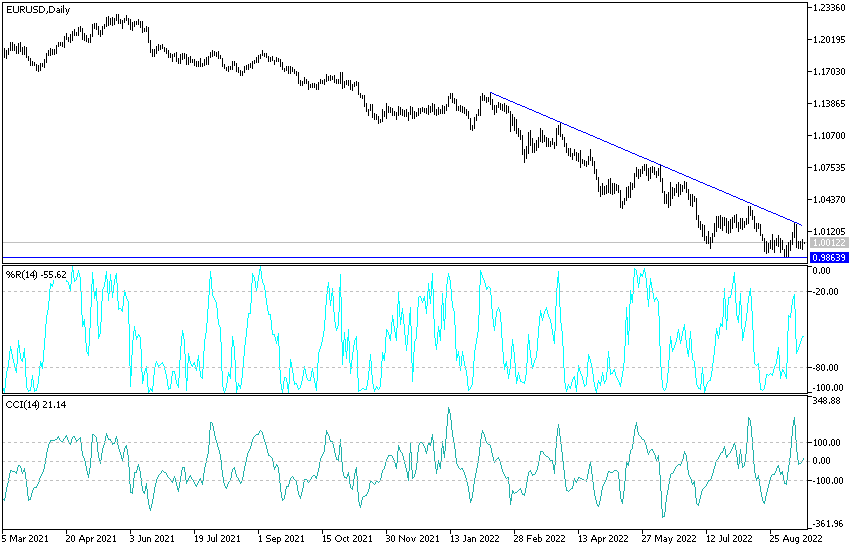

Technical analysis of the EUR/USD pair:

- The EUR/USD pair may keep moving in narrow ranges until the US Federal Reserve announces.

- In the near term and according to the performance of the hourly chart, it appears that the EUR/USD is trading within a descending channel formation.

- This indicates a significant short-term bearish momentum in market sentiment.

Therefore, the bulls will target potential profits for a rebound around 1.0001 or higher at 1.0031. On the other hand, the bears will look to extend the current declines towards the 0.9944 support or lower to 0.9918.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bears will target long-term profits at the 0.9863 support or lower at the 0.9704 support. On the other hand, the bulls are targeting potential retracements around the 1.0084 resistance or higher at the 1.0258 resistance.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.